Thinkorswim Conditional Orders - How to Set Up and Use

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

The Thinkorswim trading platform by TD Ameritrade is known for offering a lot of useful features to investors. One of those features involves being able to place conditional orders when making investments.

Many investors like using conditional orders because it allows them to buy or sell a security based on their preferred conditions being met.

This is a guide about Thinkorswim conditional orders. It will show how to set them up and how to use them.

What Is Thinkorswim?

Thinkorswim is a free trading software available from TD Ameritrade.

You can use it to buy stocks and options in the stock market.

TD Ameritrade customers can download Thinkorswim from here. It's available in different versions: desktop, web, and mobile.

Each version is unique and different from each other. This guide is going to show how to set up the desktop version of Thinkorswim.

Stock Market Guides

Stock Market Guides identifies stock investing opportunities that have a historical track record of profitability in backtests.

79.4%

What Exactly Is a Thinkorswim Conditional Order?

A Thinkorswim conditional order is an order that is based on certain conditions being met.

These conditions can be related to factors such as the price of a stock or the values of popular Thinkorswim indicators. The order will only be deployed and potentially filled if and when the specified conditions are met.

This can be helpful to investors because it offers an automated way of ensuring your preferred investment criteria are met so that you don't have to manually keep monitoring those criteria.

What Types of Conditional Orders Are Available in Thinkorswim?

There are various types of conditional orders available in Thinkorswim. Here are some examples:

-

Conditional orders based on the price of a stock itself, or based on the price of other equities or indices (such as the S&P 500).

-

Conditional orders that are based on indicators or studies available in Thinkorswim.

-

Conditional orders placed only after a particular time. If you know you will want to make a transaction at some point in the future, you can set that up now using a conditional order.

Conditional orders can be helpful if you're using specific trading strategies that involve waiting for particular criteria to occur.

For example, if you want to buy a stock only once the RSI indicator goes below a value of 30, then you can set up a conditional order to do that.

How Do You Set Up Thinkorswim Conditional Orders?

Here are the steps to set up a conditional order in Thinkorswim:

-

Go to the "Trade" tab in Thinkorswim.

-

Within the "Trade" tab, select the "All Products" sub-tab.

-

Find the specific stock or option for which you want to set up a conditional order. Right-click anywhere on the row representing that stock or option.

-

In the menu that appears, choose either "Buy" or "Sell," depending on whether you want to set up a buy or sell conditional order.

-

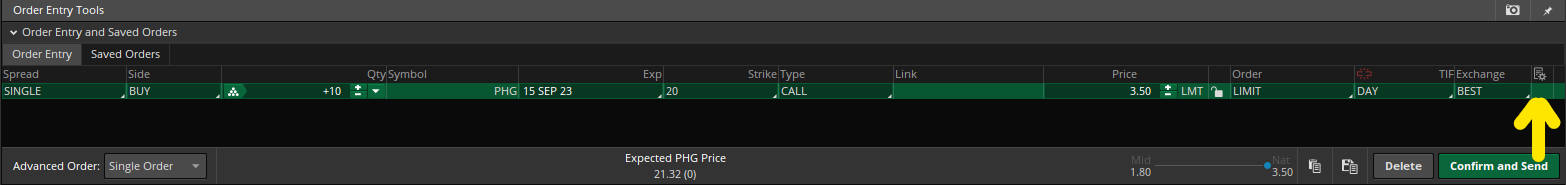

A window will appear where you can input order details, as shown in the image above. To set up the conditional order, mouse over and click on a hidden gear icon (looks like a small green or red square until you mouse over it) in the order window. In the image above, that square is right above the yellow arrow. It's like a treasure hunt trying to find that gear icon since it only appears after you mouse over it.

-

In the newly opened window, you can indicate the conditions for your order. For example, you can specify conditions based on stock prices, indicators, or time.

-

In that same window, you can enter the order itself that you want submitted once the conditions are met.

-

Click "Save" to apply the condition to your order. Then click "Confirm and Send" to submit the order, which will open a confirmation window.

-

Review the order and its condition in the confirmation window.

-

Once you are satisfied with the setup, you can click "Send" to submit the conditional order. The order will only be deployed when the specified condition is met.

Another way you can get to that conditional order window is to right click on a Thinkorswim chart and then select either Buy or Sell, and follow the same steps starting from number 5 above.

This video about Thinkorswim conditional orders shows how to do each of those steps:

The Thinkorswim layout we used in that video was a custom one we created here at Stock Market Guides. It's available for free and you can learn how to use it in this guide about setting up Thinkorswim.

Example of a Thinkorswim Conditional Orders

Let's say you have a call option for Apple with a strike price of $180 and an expiration date of September 1st. You want to set up a conditional sell order based on the stock price of Apple. Here's how you might do it:

-

Right-click on the existing call option in Thinkorswim.

-

Select "Sell" (since you want to sell this option).

-

In the order window that appears, mouse over and click on the hidden gear icon to set up the condition.

-

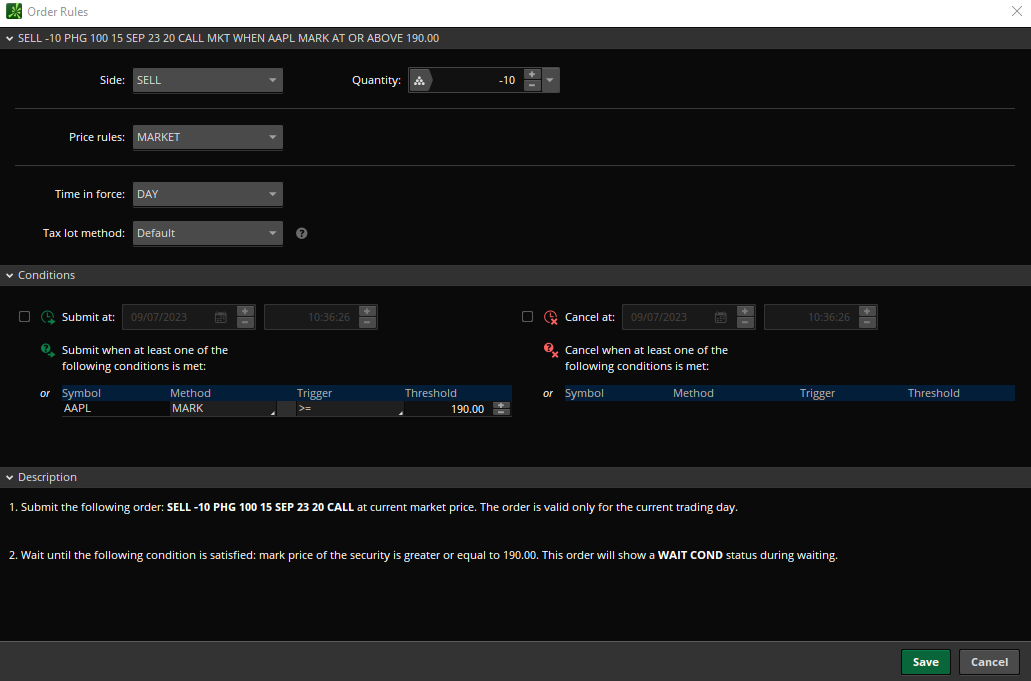

In the condition setup window, specify the condition: "If the current price of Apple stock (the mark price, which is the midpoint between the bid and ask) is greater than or equal to $190."

-

In that same window, set the order itself to be a market order. This means that once the condition is met, a market sell order will be deployed. Here is what the window looks like after you've done these steps:

-

Click "Save" to apply the condition to your sell order. Then click "Confirm and Send".

-

Review the order and condition in the confirmation window.

-

If you're satisfied, click "Send" to submit the conditional sell order. In this example, your conditional order states that you want to sell the call option when Apple's stock price reaches or exceeds $190. Until that condition is met, the order will not be deployed, and it will wait in the system. Once the stock price reaches $190 or higher, the order will be activated and likely filled as it's set as a market order.

Learning More About Thinkorswim Conditional Orders

You can contact us any time if you would like to ask any questions about Thinkorswim conditional orders or anything about trading in general.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.