Meaning of 52-Week Low in the Stock Market

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

The 52-week low is a key term that you may often hear as you explore new stocks and trading strategies.

This article explores the meaning of a 52-week low, how to find the 52-week low of any stock, and how it can inform your next move in the market.

52-Week Low Definition

There are 52 weeks in a year, and a stock’s 52-week low provides a point of reference about the price range of a stock over the last year.

As you look at the price activity of any stock, it can be helpful to see its range of price at any given time. It helps you understand how a stock’s current price relates to its performance over the last year.

Stock Market Guides

Stock Market Guides identifies stock and option trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

How to Identify a Stock's 52-Week Low

Take a look at the daily stock chart for Amazon (AMZN) below. Each green or red price bar represents one day of price activity. This chart begins on February 9th and covers one year (52 weeks) of stock price activity, as indicated by yellow brackets.

To find the 52-week low within this period, simply look for the lowest price on the chart. In this example, the lowest price was $88.12 on March 13th. No other prices are lower than that, making it the 52-week low of that period.

For a visual walkthrough of how to identify a 52-week low on a daily stock chart, check out this video.

How the 52-Week Low Can Help You

Depending on your strategy, the 52-week low may help you determine your next stock trade.

For example, a strategy some investors use is to buy low and sell high. Basically, if the price of the stock is close to its 52-week low, that may represent an opportunity to buy low on that stock, and then sell at a later time and higher price.

Alternatively, some investors might see a stock at its 52-week low as a signal that the stock could be shorted or otherwise avoided since it might be in a downward trend.

Understanding the market and helping you make informed stock investing decisions is Stock Market Guides’ primary goal. We shine light on real-world data – specifically, historical data – and show you how given different investment opportunities have performed in the past.

For example, we look at stocks that reach their 52-week lows and evaluate how they have performed historically at other times when they had hit 52-week lows. This way, when a stock meets that criteria, you can look at our data and determine for yourself whether or not the stock has offered profitable opportunities historically – and, if so, whether that’s something you want to act on.

How Do You Find Stocks at Their 52-Week Lows?

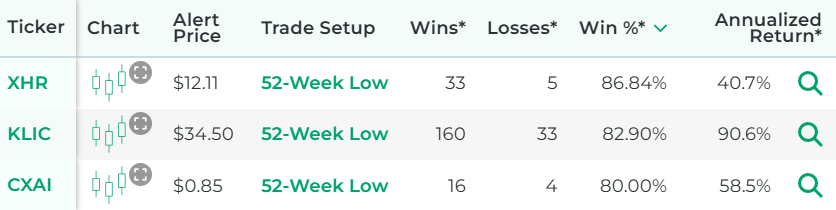

You can find them by using our 52-Week Low scanner. It's a free tool we offer here at Stock Market Guides. It uses our proprietary scanning technology to find stocks are at their 52-week lows.

Here's how the scanner results look:

That tool ensures that you don't have to waste time flipping through stock charts manually to find stocks at their lowest price in the last year.

How Well Does Buying 52-Week Low Stocks Actually Work?

The idea of a trading strategy of buying stocks at their 52-week lows sounds nice to many people because it offers a clear, easy-to-understand way to find a trade setup.

But does it actually work? Can traders indeed generate profits by doing that?

That's exactly what our company can help answer for you, since our scanner technology has allowed us to do our own research on that precise question.

The answer is that trades based on 52-week lows are not always profitable, but many times they are. For certain stocks, they might have a particularly strong track record of success according to our backtest research.

Here is some data that shows how a proprietary 52-week low trading strategy we created has performed historically according to backtests:

Wins

---

Losses

---

Win Percentage

---

Annualized Return

---

Anyone who signs up for our stock investing scanner service will be able to see stocks that qualify for that trading strategy in real time.

Learn More About 52-Week Lows in Stocks

If you have questions about 52-week lows, or anything else related to the stock market, contact us any time. You can also check out our services to see how stocks have performed historically when nearing their 52-week lows to inform yourself prior to making your next investment decision.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.