Bid vs Ask - A Simple Example

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

The bid and ask are two key elements that determine the current price of any given stock or option.

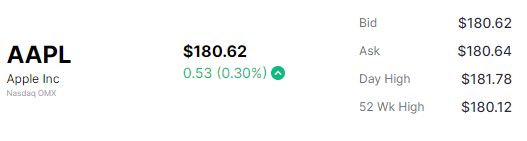

Most times when you look up a stock price, you will be able to see the bid and ask prices indicated, like this:

That's an image from the Tradier's trading platform.

It shows how it looks when you check the price of Apple stock.

There is sometimes a bit of a learning curve in terms of getting a handle on how the bid and ask work, but the following example should help make it easier to conceptualize.

Bid vs Ask Example

Imagine there are 100 people who want to buy stock for Apple. Each one has a particular price they are willing to buy it for. Imagine that one guy is willing to pay 150.00, one guy 149.98, one guy 149.91, and so on.

If you take the highest of those prices from all the people who have an order to buy Apple stock, that is the "bid" at any given time.

And in reverse, if you look at all the sellers, the one who is willing to sell it for the lowest price represents the "ask" at any given time.

So let's say, for example, the highest price a buyer is willing to pay is 150.00 (bid) and the lowest price a seller is willing to sell for is 151.00 (ask).

Stock Market Guides

Stock Market Guides identifies stock and option trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Video Explaining Bid vs Ask

This video we made about the bid and ask might help you get a better understanding:

What is the Midpoint of the Bid and Ask?

The midpoint is calculated by taking the exact middle price between the bid and the ask. For the example above, the midpoint price is 150.50, right in between 150.00 and 151.00.

A lot of times when you are trying to buy a stock or options contract, you will end up paying a price that is somewhere in the middle between the bid and the ask.

Should I Buy a Stock at the Bid, the Ask, or In Between?

If you see that 150.00 is the bid and 151.00 is the ask and you want to buy Apple stock, where should you place your order?

If you place a "market" order, it will automatically buy Apple stock at the ask price (in this case, 151.00). That might be paying a higher price than necessary to get into the stock, but it ensures you get in immediately and secure a position.

If you instead place a "limit" order, it means you get to specify the price you want. Many people set the price as the midpoint (in this case 150.50).

So if you do it that way and your order gets filled, you save 50 cents per share in this example. The tradeoff, though, is that your order might not get filled. Maybe the stock price takes off and goes up, and you miss the train.

So you might end up with a better price many times by using limit orders, but you might also sometimes miss the trade altogether.

Ultimately, it's up to you which tradeoff you prefer. If you care more about making sure you get into a trade, then a market order might make sense, or perhaps a limit order where the price leans closer to the ask. This decision might be more sensitive for active traders, like swing traders, who turn over positions more frequently than long-term investors.

If you care more about getting a low price and are ok if the stock takes off without you ever getting into the position, then you can consider placing a buy limit order at the midpoint or below.

There is no perfect trade type since there are tradeoffs with both. The key is to understand the tradeoffs so you can decide for yourself which is best for your trading style and for the specific trade you're making.

Having a handle on how the bid and ask will go a long way in deciding what type of buy order you want to place.

Bid vs Ask Conclusion

The bid and ask are essentially the two opposing forces that determine the price of a stock or option at any given time. We hope the example above makes it easier to visualize how they work.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.