Out Of The Money Options: Definition and Example

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

You may have heard options sometimes referred to as being "out of the money". If you're not familiar with the term, then you're in the right place to learn more about it.

For any given set of options, there are often a number of different strike prices available. Out of the money options refer to a distinct set of strike prices for any series of options. They have unique characteristics that are helpful to be aware of if you're considering investing in options.

Meaning of Out of the Money Options

The formal definition of out of the money options is as follows:

For call options, those are options where the strike price is higher than the stock price.

For put options, those are options where the strike price is lower than the stock price.

This video about out of the money options might help improve your understanding:

Stock Market Guides

Stock Market Guides identifies option trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

150.4%

Example of Out of the Money Options

Now that you know the book definition, let's look at an example to make it easier to connect the dots on what out of the money options are.

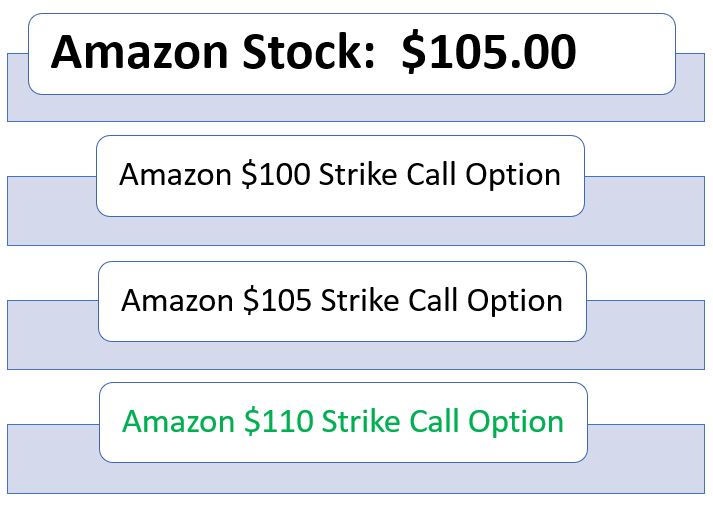

Imagine that you're considering the idea of buying Amazon options, and imagine that Amazon stock is selling for $105.

Now imagine that you're evaluating three call options, as shown in the image below:

Since these are call options, we know that any options where the stock price is lower than the strike price will be out of the money.

In the example above, the option in green text is the only option that meets that criteria, as the stock price of $105 is lower than the strike price of $110. The other two options do not meet that criteria and are therefore not out of the money.

Options that are not out the money are either in the money or at the money.

It doesn't matter what expiration date these options have since that doesn't affect whether any given option is out of the money.

Cost of Out of the Money Options

Option prices are made up of two components: intrinsic value and extrinsic value.

Intrinsic value represents how far in the money the option is. Since out of the money options have no intrinsic value, it means their price is made up entirely of extrinsic value.

Extrinsic value is typically highest in the strike prices that are closest to the stock's price. Therefore the the further out of the money the option is, the lower the extrinsic value typically is.

Learning More About Out of the Money Options

If you need more help getting up to speed on out of the money options or options in general, take a look at our guide to options trading for beginners.

Our option trade alerts service does the work for you and delivers option picks directly to you.

If you'd rather leave it to the pros but still want good option investment ideas, you can consider signing up for our options alert service.

You can contact us any time if you would like to ask any questions about extrinsic value or about options in general.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.