What Is a Strike Price in Stock Options?

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

When it comes to any given stock option, the strike price is a key characteristic that affects its value.

If you're wondering what a strike price is, then you're not alone. Anyone who wants to learn how to invest in options will need to learn it at some point.

This guide explains what a strike price is and gives examples of how it can affect your decision about which options to buy or sell.

What Is a Strike Price?

Let's start with the formal definition:

That might be a bit hard to digest at first, so we'll use this article to try to make it easier to understand.

One thing that causes confusion for many is that some investors buy options with the intent to exercise them (in other words, to ultimately buy or sell stock), and some investors buy options with the intent to later sell the option without ever exercising it.

First we're going to examine the perspective of buying options with the intent of exercising them since that helps get a foundational understanding of what a strike price is.

Toward that end, it helps to understand that stock options represent an option to buy or sell an underlying stock. Call options give you the option to buy a stock and put options give you the option to sell a stock.

Here is another way of defining what a strike price is based on whether it's a call or a put:

That might still be a little hard to conceptualize, so let's look at an example.

Stock Market Guides

Stock Market Guides identifies option trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

150.4%

Example of a Strike Price

Imagine we are looking at Apple call options. That means the options give you the right to buy Apple stock at the strike price of the option.

Now imagine that the price of Apple stock is $100.If you see an option where the strike price is $150, it means you have the right (the option) to buy Apple stock at $150. But why would you exercise that right if you could just buy the stock itself for much less?

You may not want to exercise that right today, since there is no financial incentive to do so, but if you buy the option for a very affordable price (say 10 cents) and the price of Apple stock eventually goes up to $175 before the expiration date, then you might consider exercising the option.

At that point, you'd be able to exercise your right to buy Apple stock for $150, which would be lower than the $175 stock price. When the stock price is higher than the strike price of a call option, it is said to have intrinsic value.

This underscores a key aspect of any given strike price: it is either in the money or out of the money.

Which Strike Prices Are in the Money or Out of the Money?

Let's look at another example that is based on Apple stock:

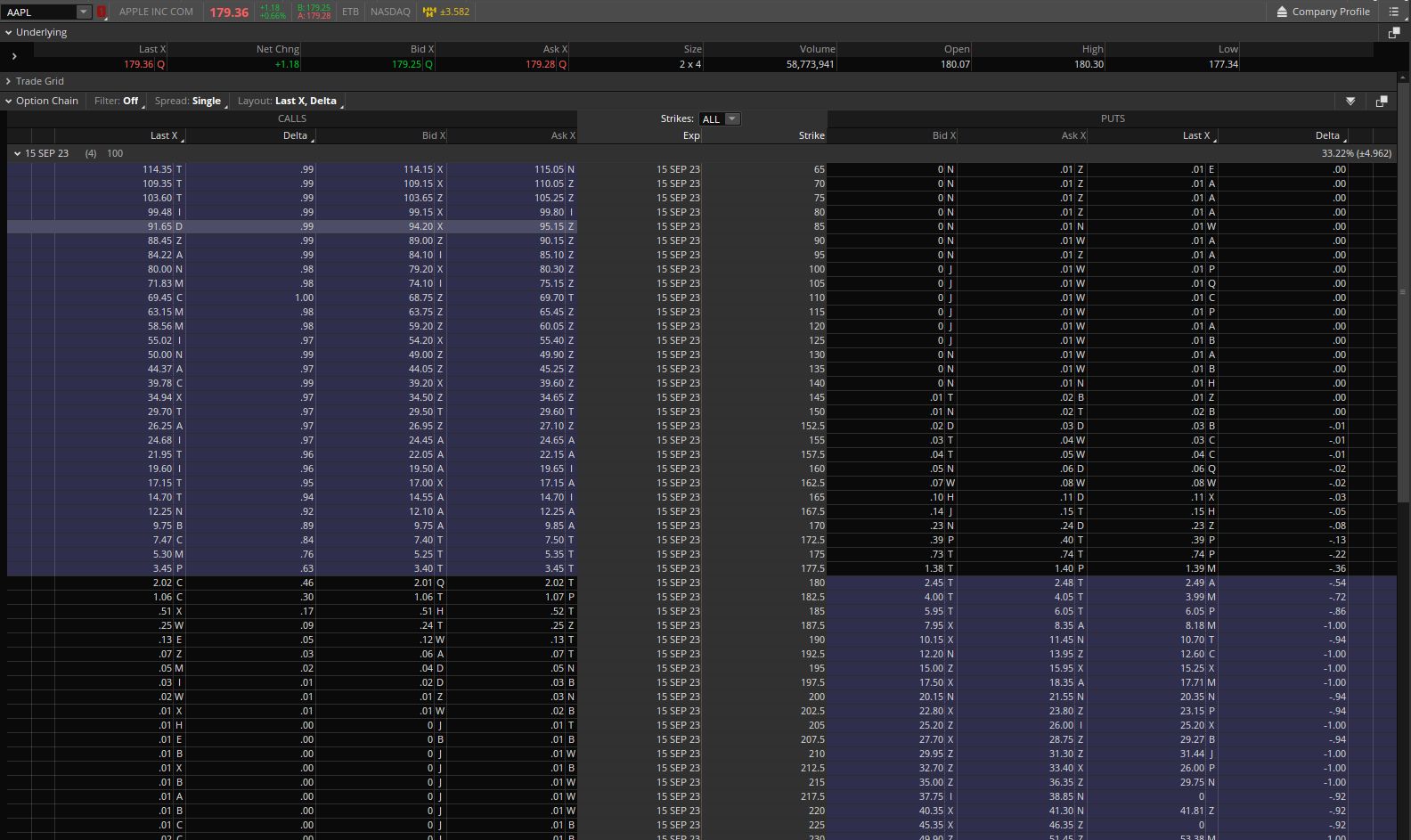

Looking at the call options on the left side, we know that these give us the option to buy Apple stock at the strike price.

Any call options where the stock price (179.36 in this example) is lower than the strike price will be out of the money. There would be no financial incentive to exercise the option because you could just buy the stock itself for less. The options with a black background are out of the money.

Any call options where the stock price is higher than the strike price will be in the money. These options allow you to buy the stock for a lower price than the stock currently sells for. The options with a dark blue background in the image above are out of the money.

It doesn't matter what expiration date these options have since that doesn't affect whether any given option is out of the money.

Does the Strike Price Matter if You Don't Plan to Exercise the Option?

A lot of people who invest with options don't actually intend to exercise the option. They don't want to convert the options into a stock position.

Swing traders and day traders, for example, make trades or investments that are intended to be held just for a short period of time, such as days or weeks.

They're just buying and selling the options with the intention of making a profit on the change in price of the option itself.

Although those investors aren't planning to exercise the option, the strike price still matters because it has an impact on the valuation of each option.

To understand how, first it's important to understand that an option's price is made up of exactly two components: intrinsic value and extrinsic value. Let's see how the strike price affects both these values.

How the Strike Price Affects Intrinsic Value

Intrinsic value is one component of an option's price. For call options, if the stock price is higher than the stock price, you take the difference and that is the intrinsic value (it can never be below zero). For put options, it's the reverse and the strike price needs to be higher than the stock price for it to have intrinsic value.

As you might be able to imagine, the deeper in the money that an option is, the more intrinsic value it has. As a result, the typical case for call options is that the lower the strike price, the higher the price. For puts, it's the reverse.

How the Strike Price Affects Extrinsic Value

Extrinsic value is the difference between an option's current price and its intrinsic value. In other words, if you take the amount that the option is in the money, and subtract it from the option's current price, that is the extrinsic value.

Extrinsic value can be thought of as a premium you pay to be able to control an option.

We talked earlier about an example where Apple stock is currently selling for $100. Let's look at that again.

There might be a call option available with a strike price of $150, and even though there is no logical reason to exercise a $150 strike call option right now, it's possible the stock price will go above $150 before the option's expiration date.

Because of that, there might be people interested in buying the $150 strike options. In that case, whatever price is paid for that option is made up entirely of extrinsic value since the option clearly has no intrinsic value.

The amount of extrinsic value that any given option might have could depend on its strike price. In general, the closer an option's strike price is to the stock price, the more extrinsic value it has. That means that deep in the money or deep out of the money options typically have less extrinsic value than, say, at the money options.

This video entitled "What Is a Strike Price in Options" might help improve your understanding:

FAQs About Strike Prices

Sometimes we get asked whether a stock price is tied to the strike price at all, and the answer is no, it's totally independent. The stock price is moving based on all sorts of different market supply and demand factors and it's not tied in any way to the strike price.

Regarding active options trading, where you buy and sell options without ever intending to exercise them, we sometimes get asked whether the strike price should be equivalent to your stop loss or profit target.

The answer is that if you are not planning to exercise the option, then the strike price in and of itself is not inherently tied to any particular exit strategy you might have. The strike price affects the valuation of the option, but if your plan is just to buy and sell the option without exercising it, you could use anything from a $5 strike to a $500 strike.

In other words, your decision for which strike price to choose does not necessarily have to revolve around a profit target or stop loss, although you certainly might choose to do that as a part of your strategy for separate reasons. The key is to understand that if you don't plan to exercise the option, then the way that the strike price relates to the stock price in and of itself only matters insofar as it affects the option's price.

Learning More About Strike Prices

If you need more help getting up to speed on strike prices or options in general, take a look at our guide to options trading for beginners.

Our option trading scanner service finds live trade setups that have a backtested edge. You can review the scan results to research option trading opportunities.

If you'd rather leave it to the pros but still want good option investment ideas, you can consider signing up for our options alert service.

You can contact us any time if you would like to ask any questions about strike prices or about options in general.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.