Gap Risk Meaning - With an Example

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Sometimes in a conversation about the stock market, you might hear someone say, "the stock gapped down overnight". Gapping down is a form of gap risk.

This article will explain what the term gap risk means in the context of the stock market.

Gap Risk Definition

To understand the meaning of the term "gap risk", first you need to understand that the US stock market is not open 24 hours a day. There are periods when it is closed and no one can trade stocks.

During those periods when the stock market is closed, sometimes news or events occur that can affect a stock's price. An example of this when a company reports earnings while the stock market is closed.

This can cause pressure on the stock price such that by the time the stock market opens the next day, it can be trading at a different price than it was trading for at the end of the prior day.

With that in mind, here is the formal definition:

Stock Market Guides

Stock Market Guides identifies stock trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Gap Risk Examples

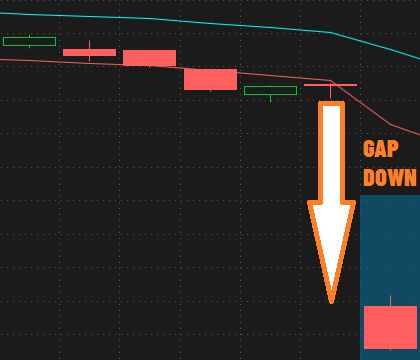

The image above shows a stock chart for Advance Auto Parts (AAP). It's a daily chart which means that each of the price bars represents the price activity for one day during normal open stock market trading hours.

A candle that is green means the price went up during normal trading hours for that day. If it's red, it's the opposite and it means the price went down during normal trading hours.

You can see in the image above that the last price bar reflects an opening price that is well below the closing price of the prior day. That is a gap down, and it's an example of the risk that investors face by owning stocks overnight.

That one is a particularly large gap down. Not all gap downs are that pronounced.

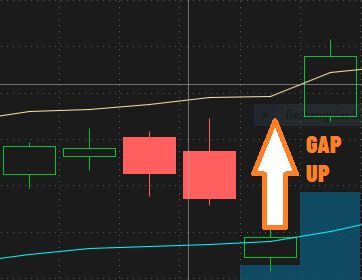

Gap risk goes both ways, though. Stocks can also gap up, which is a potential reward that investors might earn by taking on gap risk.

That image is an example of a gap up. You can see that the last price bar reflects an opening price that is well above the closing price of the prior day.

Video About Gap Risk

This video we made about gap risk might be helpful:

Who Faces Gap Risk?

Anyone who holds a stock or option position overnight faces gap risk.

This means that anyone who has long term investments in the stock market are exposed to gap risk. Also, swing traders are exposed to gap risk.

Day traders often close all their positions before the end of the trading day, which makes them unsusceptible to any overnight price changes.

Is Gap Risk Worth It?

Data shows that in the last hundred years, the stock market has gone up an average of 9.8% per year.

This suggests that there might be a long-term benefit to exposing yourself to gap risk.

That's not to say that you won't suffer tough setbacks from gap downs along the way if you own stocks. It's to say that if your focus is on long term gains, then the risk of gap downs may not have enough of a negative impact to offset the potential rewards that the stock market historically has offered.

If your investing horizon is shorter, such as that of a swing trader, gap risk can be a more substantial risk.

In that case, using robust swing trading strategies and a prudent position sizing approach can help you manage the risk. Our research has shown that despite gap risk, there are a number of swing trading strategies that have exhibited profitability in back tests.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.