Meaning of Uptrend in the Stock Market

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Uptrends in the stock market are common, and being able to identify them will help inform your trading strategies.

This article explores the definition of uptrends, how to identify an uptrend on a stock chart, and how it could inform your future investment decisions.

Uptrend Definition

Uptrend is a simple yet important term that will help you navigate the stock market.

Stock Market Guides

Stock Market Guides identifies stock and option trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Example of an Uptrend

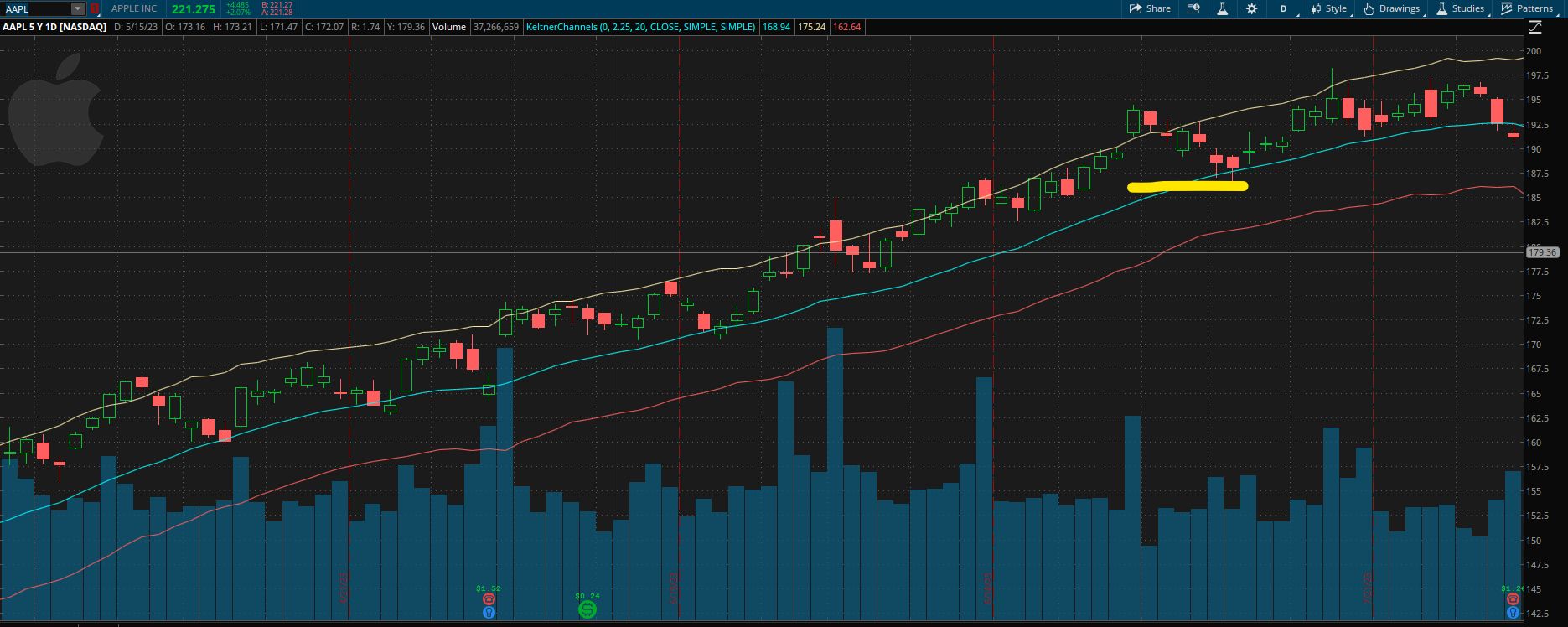

Let’s illustrate an uptrend with a stock chart for Apple (AAPL) below. An uptrend is visible as a chart pattern on a stock chart.

If you lean back and take a look at the chart as a whole, you can see that the price is going up over time. The price generally starts at the bottom left, and it ends at the top right: trending upward.

Simply put, that is what an uptrend looks like. However, there are several ways to identify an uptrend over various periods of time.

For example, take another look at the price bars in the example above. Each price bar represents one day of price activity, spanning from April to July, a four-month period.

You could say a stock is trending up for just a one-week period, or you could look at just one day’s price activity. At a more granular level, even minute-by-minute activity, you may find an uptrend.

How to Identify Stocks in an Uptrend

While you can simply look at a chart and identify an uptrend by seeing price activity start at the bottom left and end at the top right, there are more defined ways to identify these trends, too.

One way to identify an uptrend is by using a Keltner channel. The Keltner channel is made up of the three lines you see on a stock chart: red, blue, and tan.

To identify an uptrend with a Keltner channel, first take a look at the price activity: the little bars indicating price changes. In an uptrend, those price bars generally fall in the upper channel, between the blue line and tan line – or even higher.

In the image above, although there are a few price bars below the blue line, you can see that generally everything else falls above it.

To illustrate, let’s take a look at the specific period indicated with the yellow line below:

It would be perfectly reasonable to say, “The stock is not in an uptrend during the timeframe underlined in yellow.” However, if you consider the chart as a whole – including the data outside of the highlighted period - it could still be said that this stock is in an uptrend because most of the price activity was in the upper Keltner channel.

As you can see, there is some discretion for how you frame or define an uptrend when looking at a stock chart, but a Keltner channel can help clear this up.

Another method for identifying an uptrend might be simpler. It uses a moving average line – which, conveniently, is the middle line of a Keltner channel.

For this method, ignore the red and tan lines in the previous examples; focus only on the blue one in the center. This is our simple moving average line. You can see that the price activity is generally above that blue line.

This is another simple way to identify a stock in an uptrend: most of the price activity is above the simple moving average line.

Video About Uptrends

Check out this video for an in-depth walkthrough that shows how to identify uptrends in a stock chart.

Why Does It Matter if a Stock is in an Uptrend or Not?

Some stockholders may think that if a stock’s price is in a particular trending direction, that trend might continue. In other words, if a stock is trending up, then some may consider buying that particular stock in anticipation of it continuing its trend.

While that is a common thought, more data can give you a clearer picture of a stock’s performance over time.

Here at Stock Market Guides, we bring more data into the picture. We show you historical trends of stock performance, and what would have happened in the past if you had invested in an uptrending stock. Do trends really have a tendency to continue, or is that a myth?

We aim to shine light on historical data and answer questions like those. That way, you do not have to rely on a common saying or ideology about how to invest your cash or which stocks to buy. Instead, we provide data that says where there is an investment opportunity with a track record of profitability (or not).

How Do You Find Uptrending Stocks?

You can find them by using our Uptrending Stocks scanner. It's a free tool we offer here at Stock Market Guides. It uses our proprietary scanning technology to find stocks that are in an uptrend.

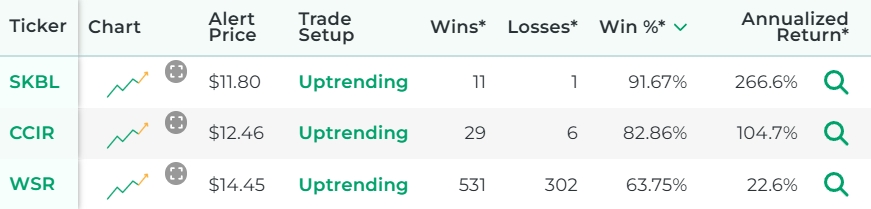

Here's how the scanner results look:

That tool ensures that you don't have to waste time flipping through stock charts manually to find uptrending stocks.

How Well Does Buying Uptrending Stocks Actually Work?

The idea of an uptrending stock trading strategy sounds nice to many people because it offers a clear, easy-to-understand way to find a trade setup.

But does it actually work? Can traders indeed generate profits by trading stocks in an uptrend?

That's exactly what our company can help answer for you, since our scanner technology has allowed us to do our own research on that precise question.

The answer is that trades based on uptrending stocks are not always profitable, but many times they are. For certain stocks, they might have a particularly strong track record of success according to our backtest research.

Here is some data that shows how a proprietary uptrending stocks trading strategy we created has performed historically according to backtests:

Wins

---

Losses

---

Win Percentage

---

Annualized Return

---

Anyone who signs up for our swing trading scanner service will be able to see stocks that qualify for that trading strategy in real time.

Learning More About Uptrends

You can contact us any time if you would like to ask any questions about uptrends or anything else related to the stock market.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.