What Would Warren Buffett Invest In if He Were You?

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Have you ever wished that someone could just tell you how to make money in the stock market?

Well good news. Your wish has come true. And not only that, but the person telling you how to do it is no less than the Oracle of Omaha himself, Warren Buffett.

He has a legendary track record of getting excellent returns on his investments. He earned his billionaire status from investing in the right companies and holding for the long term. He’s widely considered the king of value investing.

What Would Warren Buffett Invest In?

So what does Buffett advise the commonfolk like us to invest in?

It’s simple: VOO

That’s a ticker symbol you can buy and hold for the long run.

Why VOO? It’s because VOO is the ticker for the Vanguard S&P 500 ETF. In other words, it gives you a way of owning “the market”.

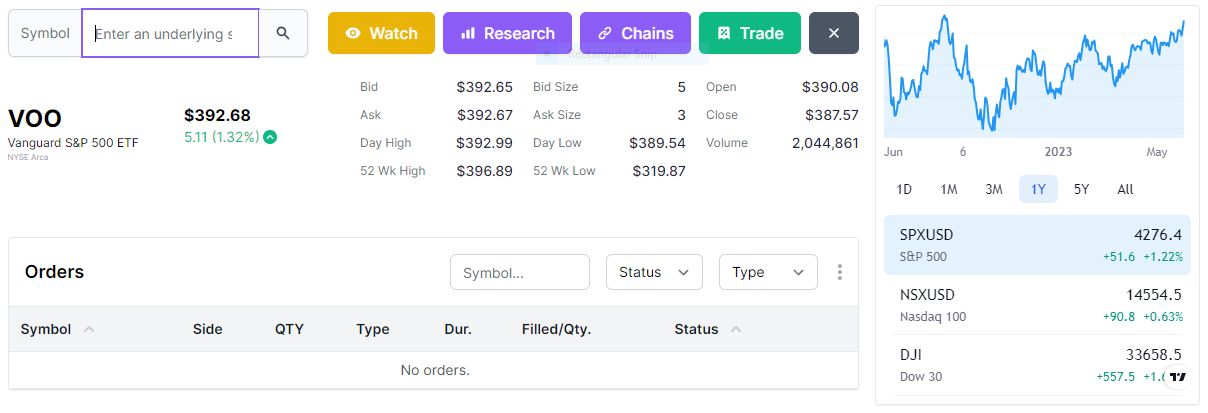

Buying shares of VOO is the same as buying a stock. You simply log in to the trading platform your broker offers, type in the ticker symbol "VOO", and click the Buy button if you are ready to purchase it.

That's an image from the Tradier's trading platform that shows how it looks when you type in the ticker VOO.

Stock Market Guides

Stock Market Guides identifies stock investing opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Warren Buffett's Advice

Buffett has long endorsed the idea that unless you’re a professional investor, the best way to invest is simply to “buy the market”. Unless you can dedicate a full-time effort to researching each investment, then he advises it’s best to invest in the market as a whole (which has made a 9.8% average annual rate of return going back almost 100 years).

He believes it so strongly that he even once made a $500,000 bet that no hedge fund managers could outperform the Vanguard market ETF over a 10-year period. In other words, he thought simply buying and holding the market would give a better return than investing with a high-priced, posh hedge fund.

Only one hedge fund manager took him up on the bet, Ted Seides, and sure enough Seides did not beat the stock market’s return over the 10-year period. And in case you’re wondering, the Seides did indeed pony up the $500k to Buffett’s charity of choice.

Video About Warren Buffett's Advice on Investing

This video we made about Warren Buffett's investing advice might be helpful:

Buffett Says to Set It And Forget It

So if you want to know what Warren Buffett would invest in if he were you, the answer is VOO. It’s traded like a normal stock ticker. So you can go into your trading platform, type in that ticker, and buy it at your discretion. That’s how you go about “buying the market”.

One more piece of Warren Buffett advice: set it and forget it. If you decide to buy some VOO, then he says he wouldn’t make a habit out of checking the account balance every day or even every month. In the biography, “The Warren Buffett Way”, he mentions that he thinks checking the balance once a year is enough.

The reason is because over the long haul, dating back more than a century, the market has always gone up. Yes, it will have setbacks and periods of volatility, but if you simply wait long enough, it always has eventually gone back up. So checking the account balance very infrequently can help ensure your mind doesn’t get in the way of an otherwise profitable long term investment.

Conclusion

This article shows that the best investment path for us might really be the best of all worlds for many of us.

The stock market advice from Warren Buffett is to simply buy the market and then forget about it. We don’t have to regularly check our account balance. It’s a very easy, peaceful approach to making money in the stock market.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.