Stock Fundamentals

Learn stock fundamentals here and access our free scanner that shows which stocks exhibit these fundamental metris right now. You'd have to upgrade to our paid service to see the historical backtested performance of the fundamental metrics for each stock.

Low P/E Ratios

Meaning of This Metric:

P/E ratio stands for Price-to-Earnings ratio. It compares a stock's price against that company's earnings. This ratio can sometimes be a telling indicator of how good an investment might be.

Finding Stocks With Low P/E Ratios:

You can see which stocks have low P/E ratios today by using our Low PE Ratio scanner.

Undervalued Blue Chip Stocks

Meaning of This Metric:

The companies with the largest market capitalizations are considered blue chip stocks. We have a scan that looks for blue chips stocks that might be available at a discount.

Finding Undervalued Blue Chip Stocks:

You can see which stocks that meet this criteria today by using our Undervalued Blue Chip Stocks scanner.

Stocks at 52-Week High

Meaning of This Metric:

Stocks at their 52-week highs are stocks where their highest stock price of the year occurred on the most recent trading day.

Finding Stocks at 52-Week Highs:

You can see which stocks meet this criteria today by using our 52-Week High scanner.

Stocks at 52-Week Low

Meaning of This Metric:

Stocks at their 52-week lows are stocks where their lowest stock price of the year occurred on the most recent trading day.

Finding Stocks at 52-Week Lows:

You can see which stocks meet this criteria today by using our 52-Week Low scanner.

Stocks Reporting Earnings

Meaning of This Metric:

These are companies who are reporting earnings tomorrow. Investing before an earnings announcement can sometimes offer lucrative rewards, but comes with added risk.

Finding Stocks Announcing Earnings:

You can see which stocks are announcing earnings tomorrow by using our Earnings scanner.

Low P/S Ratios

Meaning of This Metric:

P/S ratio stands for Price-to-Sales ratio. It compares a stock's price against that company's sales. This ratio can sometimes be a telling indicator of a stock's price growth prospects.

Finding Stocks with Low P/S Ratios:

You can see which stocks have low P/S ratios today by using our Low PS Ratio scanner.

Low P/B Ratios

Meaning of This Metric:

P/B ratio stands for Price-to-Book ratio. It compares a stock's price against that company's book value, where book value is the net value of a company's assets. This ratio can sometimes be useful for finding good investments.

Finding Stocks with Low P/B Ratios:

You can see which stocks have low P/B ratios today by using our Low PB Ratio scanner.

Low Debt-to-Equity Ratios

Meaning of This Metric:

The debt-to-equity ratio look at the company's total liabilities and compares it to the total amount of shareholder's equity. Low debt-to-equity ratios can indicate financial strength and a possible good investment opportunity.

Finding Stocks with Low Debt to Equity Ratios:

You can see which stocks meet this criteria today by using our scanner for stocks with low debt-to-equity ratios.

Stocks with a Cash Surplus

Meaning of This Metric:

A cash surplus simply means that a company has a large cash position. This can indicate financial strength for the company and therefore might be an indicator of a good investment opportunity.

Finding Stocks with a Cash Surplus:

You can see which stocks meet this criteria today by using our scanner for stocks with a cash surplus.

Increasing Profit Margins

Meaning of This Metric:

The profit margin of a company is its net profit divided by its revenues. If the profit margin is increasing, that is a sign of strength and potential future growth in the value of the business.

Finding Stocks with Increasing Profit Margins:

You can see which stocks meet this criteria today by using our scanner for stocks with increasing profit margins.

Increasing Book Value

Meaning of This Metric:

The book value of a company is the net value of a company's assets. If that value is increasing, it might be an indication that the company's strength is growing and that it might therefore be a good investment.

Finding Stocks with Increasing Book Values:

You can see which stocks meet this criteria today by using our scanner for stocks with increasing book values.

Blue Chips with Low PE Ratios

Meaning of This Metric:

The companies with the largest market capitalizations are considered blue chip stocks. We have a scan that looks for blue chips stocks that low P/E ratios, meaning the stock's price compared to the company's earnings is low.

Finding Blue Chips with Low P/E Ratios:

You can see which stocks that meet this criteria today by using our scanner for blue chip stocks with low PE ratios.

Undervalued Stocks

Meaning of This Metric:

If a stock is undervalued, it might offer a good investment opportunity as the stock price might gravitate toward its fair value over time. There are a variety of ways to determine whether a stock might be undervalued, including its price-to-earnings ratio, it's price-to-sales ratio, and more.

Finding Undervalued ETFs:

You can see which stocks that meet this criteria today by using our Undervalued Stocks scanner.

To get alerts when stocks exhibit any of these stock fundamentals, and to see how they performed historically in backtests for each stock, you can sign up for our Stock Investing Service.

Stock Fundamentals Scanner

Our Stock Investing Service includes access to our proprietary stock scanner technology. Our stock fundamentals scanner identifies investment opportunities that have a backtested edge. Here at Stock Market Guides, our specialty is bringing data and statistics to your investing decisions. With every stock investment setup that comes up in our stock fundamentals scanner, you’ll be able to see exactly how that setup has performed historically in backtests. This allows investors to make fully informed investing decisions. There’s no longer a need to take a blind leap of faith when making a stock investment.

How Our Stock Fundamentals Scanner Works

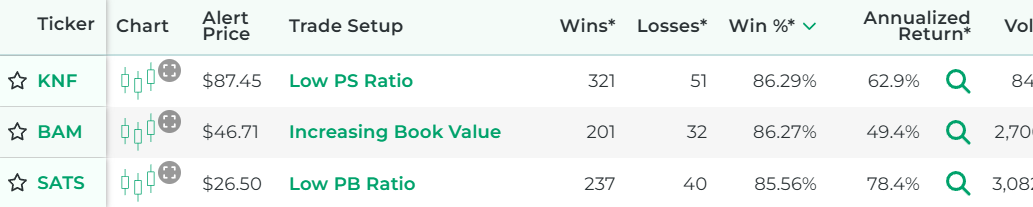

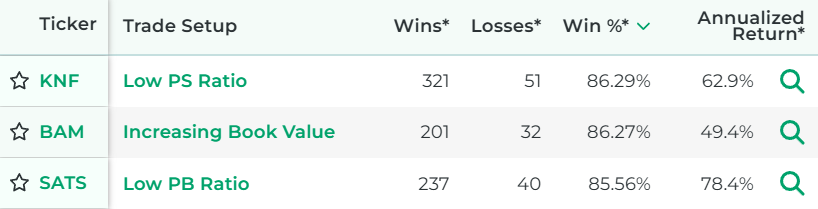

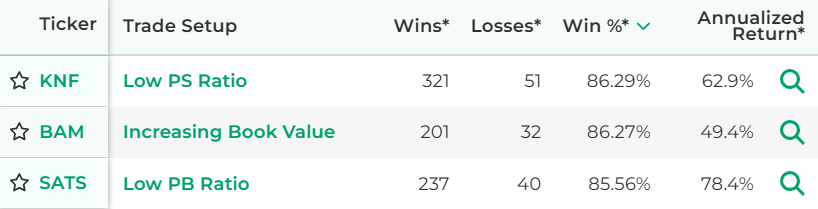

Here’s an example of what the results look like from our stock fundamentals scanner. You can see that each scan reflects a specific investing strategy based on stock fundamentals. Each scan result shows not only the stock, but also how the stock performed historically for that investing strategy according to our backtest research.

Features of Our Stock Fundamentals Scanner

Shows Historical Performance

What makes our stock scanner one-of-a-kind is that each scan result shows how that stock performed in backtests when the specified stock fundamental criteria was met in the past. Why waste time or money considering stock fundamentals that don’t have a track record of success?

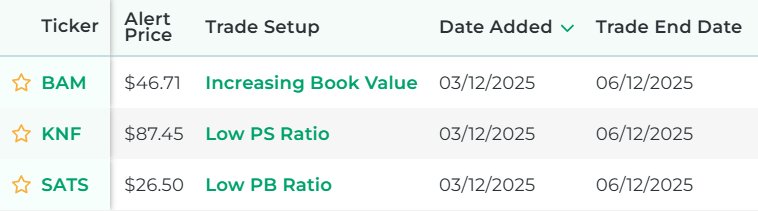

Gives Complete Trade Setups

Each scan result offers a full trade setup based on the stock fundamentals our scanner identified. It gives you a specific amount of time to hold the position. This takes the guesswork out of your investing decisions. You know exactly how long to hold the position.

Get Alerts for New Scan Results

If you pay for our service, then you can enable alerts for any stock fundamental scans you want. This means you will get alerted each time our scanner finds new stock fundamentals that have a backtested edge. Alerts can be sent by email or text. You can set your preference after you sign up for the service.

- Find Stock Investment Ideas That Have a Backtested Edge

- Has DIY Stock Investing Scanner

- Get Stock Picks from Our Scanner: 43.1% Average Annualized Return in Backtests

FAQs about Stock Fundamentals

Here are frequently-asked questions about stock fundamentals and why they might be important to investors.

What exactly are stock fundamentals?

Stock fundamentals are the core economic factors that drive a company’s financial health. They reflect the how a company is performing financially.

What are examples of stock fundamentals?

Stock fundamentals include metrics like the company’s earnings, revenue, debt, and assets. This image is an example of the Price-to-Earnings Ratio, which divides a stock’s share price by its earnings per share.

Why do stock fundamentals matter?

Stock fundamentals can offer a way to determine if a stock is a good prospect to buy or not. Frequently, fundamental analysis is used to determine if a stock is undervalued, which means that the stock might be trading at a price that is lower than its fair value. This information can be used to potentially profit from buying the stock. Fundamental analysis is especially popular among buy-and-hold investors.

How can you use stock fundamentals to make investing decisions?

If you find a stock that has solid fundamentals, it might be an indication that it might offer a profitable investment opportunity. The challenging part is that not all stock fundamental metrics are created equal. Some perform better than others, and some stocks in particular have a good track record with particular fundamental metrics. That's the piece of the equation that we put at your fingertips with our paid service. We show you the backtested performance of each stock fundamental metric.

Which are the best stock fundamentals to use for investing?

Perhaps the best stock fundamentals are the ones that have the strongest track record of success. If you sign up for our service, you'll see the historical backtested performance of each stock fundamental in real time as it occurs. This might help you decide which fundamentals are worth taking action on.

As Seen On

Customer Testimonials

The service you provide appears to be exactly as advertised. Without exaggeration, thus far your service has cut my research time by at least 35% - 40%. Regards from a happy user.

Dennis from Florida

I am extremely impressed with you for taking the time to answer my queries through a video (just for me) and the level of detail you have provided. Kudos to your service. Hope to be associated with you for a long time.

Ram from Georgia

Absolutely love your service. I've found your service to be excellent and will recommend it.

Jason from California

I have liked the service so far. I secured a couple nice wins this week.

Tim from Wisconsin

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.