Stocks With Low PE Ratios Today

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

These are stocks that each have a low PE Ratio today according to our stock scanner. PE Ratio refers to the Price-to-Earnings ratio of the company. You can sort columns or add filters in order to fine-tune the scan results.

As of ---

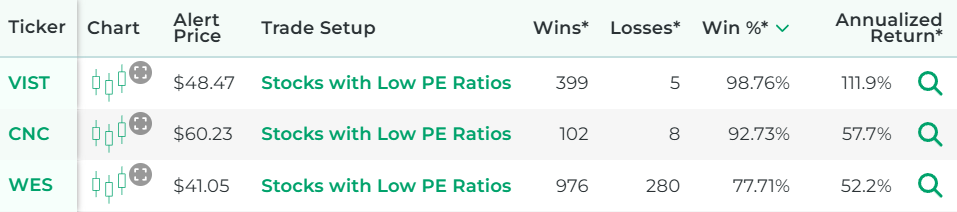

*Wins, Losses, Win Percentage, and Annualized Return are referring to how the stock performed in backtests for the Trade Setup indicated.

How to Use Our Scanner for Low PE Ratio Stocks

The above list represents stocks that have low PE ratios today.

It's powered by our proprietary stock scanner, which searches once per day for stocks that have low PE ratios.

You can sort columns using the up and down arrows next to the column name. You can add filters for the column values by clicking the "Add Filter" button above the list of low PE ratio stocks. This scanner is designed for active stock traders.

This video shows how to use our scanner:

Scanner Features that Require a Subscription

Our free scanner offers you the ability to find stocks that have low PE ratios, but you may need more than that to ensure you're making trades that have a true edge.

Our paid Stock Investing Service includes scanner features that are designed to offer you all the intelligence our research can offer. These are the scanner features you get if you pay for a subscription:

- See the historical backtested performance for each scan result. It looks like this:

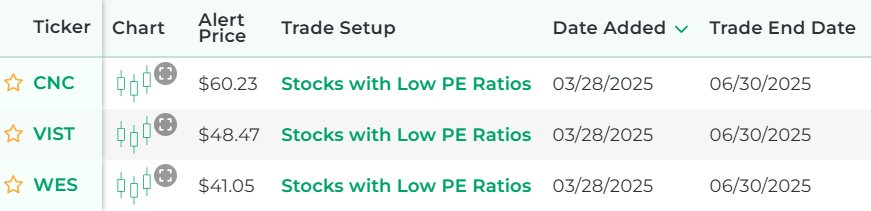

- See full trade setups for each scan result, including when to enter and exit. It looks like this:

- Get alerted when there are new scan results (by text or email).

- Get access to real-time scan updates throughout the trading day.

- Access scan results for all trading strategies in a single scan to easily see which trade setups have the best backtested performance across the entire market at any given time.

- Get access to scan results for our proprietary trading strategies, which required years of research to develop.

- Find Stock Investment Ideas That Have a Backtested Edge

- Has DIY Stock Investing Scanner

- Get Stock Picks from Our Scanner: 43.1% Average Annualized Return in Backtests

Here's a video that explains the difference between our free low PE ratio scanner and the scanner from our paid service:

Stock Market Guides

Stock Market Guides identifies stock investing opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

What Exactly Is a PE Ratio?

PE ratio (or P/E ratio) stands for Price-to-Earnings ratio. It's a fundamental valuation metric used in the stock market to evaluate a company's stock price relative to its earnings.

It’s calculated by taking the current share price of a company's stock and dividing it by its earnings per share (EPS).

The formula looks like this:

PE Ratio = (Current Share Price) / (Earnings per Share)

Here is a breakdown of the components of the calculation:

Current Share Price: This is simply the current price of the company’s stock at any given moment.

Earnings Per Share (EPS): This takes the earnings of the company over the last 12 months (as of the company's most recent quarterly financial report), and divides it by the total shares outstanding for the company. The company's earnings can be found on its income statement, and the company's outstanding shares can be found on its balance sheet.

The calculation above is the classic way to compute a company's PE ratio. It's also referred to as a trailing PE ratio since it's looking at historical earnings (actual earnings).

Companies also project earnings, and there is a metric called a forward PE ratio that uses projected earnings as the basis for the calculation.

How We Find Low PE Ratio Stocks Each Day

Our one-of-a-kind scanning technology is at the heart of everything we do here. We have a way to program a trading strategy into our scanner, and then it uses real-time data feeds to find any stocks that meet the criteria of the trading strategy.

In the case of finding stocks that have low PE ratios each day, our scanner looks for stocks that just exhibited low PE ratios on the most recent trading day.

Our Criteria for Defining Low PE Ratio Stocks

To find stocks that have low PE ratios, our scanner looks for stocks where yesterday's stock price equated to a PE ratio that is lower than ten but greater than zero.

Other Popular Scans at Stock Market Guides

Want to see scans we have for other popular indicators, chart patterns, and candlestick patterns? Check them out here:

Have Questions About Low PE Ratio Stocks or Our Services?

If you have questions about stocks with low PE ratios or questions about any services we offer, you can contact us any time and we'll be ready to help.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.