Cash Surplus - How It Works and How Investors Can Use It

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

When it comes to the stock market, sometimes you might hear the term "cash surplus" mentioned. It refers to a fundamental analysis metric that is popular among active stock traders.

This article will explain what a cash surplus is and how investors might be able to benefit from using it.

What Exactly Is A Cash Surplus?

A cash surplus is a term that refers to a company's cash position.

Each company in the stock market has some amount of cash on hand, as indicated on the company's balance sheet. It refers to the company's most liquid asset, meaning it's the asset most easily convertible to currency that can be used for immediate spending.

Put more simply, cash represents money in the bank.

When referring to a company's cash position, they can be said to have a cash surplus if they have more cash on hand than short-term liabilities.

A company's short-term liabilities, also visible on its balance sheet, refer to debts or obligations that are due within one year.

If a company has more cash than it has short-term liabilities, then it has a surplus of cash. It has more cash than it needs to service its financial obligations that will be due in the short term.

Stock Market Guides

Stock Market Guides identifies stock investing opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Why Does Cash Surplus Matter in the Stock Market?

If a company has a cash surplus, it can be seen as a sign of strength. It means the company not only has enough cash on hand to meet its short-term financial obligations, but it has excess cash beyond that.

When an investor is considering which stocks to buy, one area of differentiation between choices might be whether a company has a cash surplus or not.

If one company has a cash shortage and is struggling to meet its financial obligations, that could be seen as a sign of weakness and elevated risk. That's one reason a company with a cash surplus might be seen as a preferable alternative.

How Do You Find Stocks With Cash Surpluses?

You can find them by using our Cash Surplus scanner. It's a free tool we offer here at Stock Market Guides. It uses our proprietary scanning technology to find stocks that have cash surpluses.

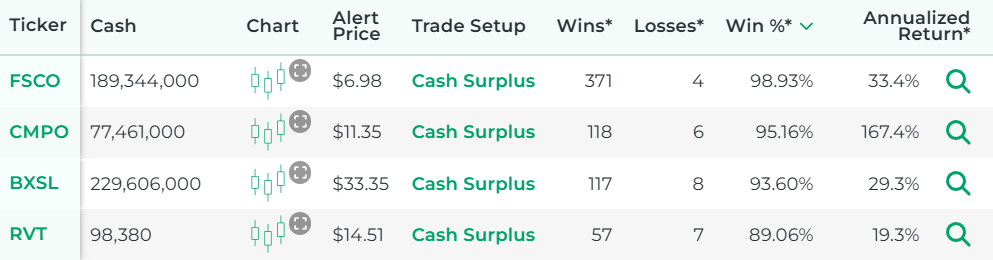

Here's how the scanner results look:

That tool ensures that you don't have to waste time flipping through stock profiles manually to find stocks with cash surpluses.

Example of a Cash Surplus Investing Strategy

For this example of a Cash Surplus investing strategy, we're going to look for stocks with a cash surplus and plan to hold them for up to a year.

Our research suggests this simple strategy might have a track record of success.

Entry for the Cash Surplus Investing Strategy

The entry for this Cash Surplus strategy will be as follows:

The entry criterion for our Cash Surplus investing strategy is very simple.

Exit for the Cash Surplus Investing Strategy

There are a lot of possibilities here for the exit.

For any given investing strategy, it can be helpful to define two different criteria for the exit: a profit target and a time limit.

Not everyone sets exit criteria for a long-term investment, and that's totally fine. Ultimately, you are in charge of your investments, and you can manage them any way you want. But for the purposes of this investing strategy example, we will define them:

- Profit Target

We will set a profit target that would reflect a 15% gain if the position were to be sold at that price.

In other words, we will take the price we paid for the stock at entry, multiply it by 1.15 (which effectively adds 15%), and use that to set up a sell limit order as a profit target.

If the sell limit order gets filled before the time limit is reached, then our investment is complete, and we will have realized a 15% return on investment.

- Time Limit

We will set the time limit as one year. If the stock has not hit the profit target within one year of the date of stock purchase, then we can close the trade manually at the stock's prevailing price.

How Well Do Cash Surplus Investments Actually Work?

The idea of a cash surplus investing strategy sounds nice to many people because it offers a clear, easy-to-understand way to find an investment idea.

But does it actually work? Can traders indeed generate profits from buying stocks with cash surpluses?

That's exactly what our company can help answer for you, since our scanner technology has allowed us to do our own research on that precise question.

The answer is that investments based on cash surpluses are not always profitable, but for certain stocks they might indeed have a track record of success according to our backtest research.

Here is some data that shows how a proprietary cash surplus investment strategy we created has performed historically according to backtests:

Wins

---

Losses

---

Win Percentage

---

Annualized Return

---

Anyone who signs up for our stock scanner service will be able to see stocks that qualify for that trading strategy in real time.

Learning More About Cash Surpluses

You can contact us any time if you would like to ask any questions about cash surpluses or anything else related to the stock market.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.