Thinkorswim Review: Good for Active Traders

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

When it comes to investing in the stock market, one name you might hear a lot is Thinkorswim.

It's a trading platform offered by TD Ameritrade that is popular among active stock market investors.

This guide serves as a Thinkorswim review. It covers all the pros and cons we've found with the platform and discusses whether it's suitable for active traders.

What Is Thinkorswim?

Thinkorswim is a free trading software available from Schwab.

You can use it to buy stocks and options in the stock market.

TD Ameritrade customers can download Thinkorswim from here. It's available in different versions: desktop, web, and mobile.

Each version is unique and different from each other.

Stock Market Guides

Stock Market Guides identifies stock trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Thinkorswim Review

We really like Thinkorswim and think it's suitable for active traders. This video offers a Thinkorswim review that highlights the features we we think are noteworthy:

Following is a list of the key features and a review of what we think about them.

Note: this isn't an exhaustive list of all of Thinkorswim's features. These are the features that stand out to us in some way and that we felt were worthy of mentioning in our review.

Thinkorswim Review: PROS

There is a lot to like about Thinkorswim from our perspectives. Here are features we like about the platform:

Paper Trading

Thinkorswim offers a simulated trading environment, also know as a paper trading, allowing users to practice trading without risking real money. This feature is beneficial for gaining experience and confidence in making trades or investments.

Not all brokerages offer paper trading, so it's a plus to see it available with Thinkorswim.

Thinkorswim Is Free

The Thinkorswim platform is free to use. It provides a sophisticated set of capabilities without any associated costs for accessing the platform itself (provided that you aren't a stock market professional).

Most trading platforms from brokerages are admittedly free, but considering how robust Thinkorswim is, we consider it to be a big plus that it doesn't cost anything to use.

Trade Stocks, Options, and Futures in the Same Account

Within a single account, Thinkorswim users can trade stocks, options, and futures. This feature is advantageous for investors who want the flexibility to trade various types of securities without needing multiple accounts.

We only know of one other broker who offers this capability, so this is a rare benefit that might be prized by some investors. The reason it's nice is because if you have to trade out of separate accounts for different security types, then you have split up your resources. That's an inefficient use of buying power and doesn't allow for as much potential compounding.

Note: trading futures and options in your account still requires separate applications in addition to the one you filled out to get your TD Ameritrade brokerage account. But if approved, you will be able to trade them out of the same account as you do for stocks.

Customizable Layouts

While the initial layout may be overwhelming for some users, Thinkorswim allows for customization.

Users can create custom layouts to suit their preferences, making it easier to navigate the platform and use all its features.

The Thinkorswim layout we used in the video above was a custom one we created here at Stock Market Guides. It's available for free and you can learn how to use it in this guide about setting up Thinkorswim.

Our custom layout allows you to see stock charts, indicators, positions, order windows, news, and watch lists all from the same screen.

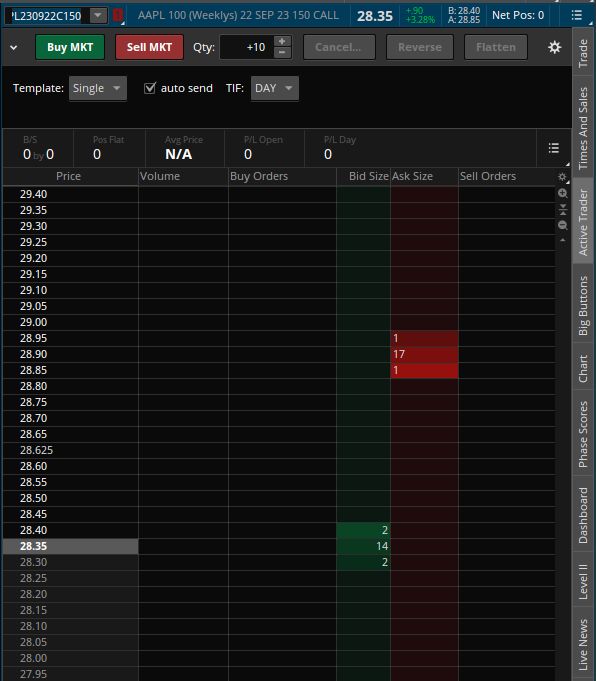

Active Trader Window

Thinkorswim has a featured called the Active Trader window. It allows you to place and edit orders very quickly. Here is a picture of what it looks like:

With most brokerages, entering an order involves going one field at a time through a number of fields, manually typing in your price, and then submitting.

With that Active Trader window, you just use your mouse to point and click the price where you want your order placed, and it submits it.

If you want to edit an existing order's price, you just drag and drop the order icon to the desired price.

The process takes seconds, which is often noticeably less than what it would take to manually fill in the fields of a traditional order form.

Lots of Charting Features

Thinkorswim offers extensive charting capabilities. This is valuable for traders who rely on technical analysis for making investment decisions.

The charts allow you to easily edit time frames, add indicators or studies, draw trend lines, and see upcoming earnings and ex-dividend dates.

To see a full list of the chart features available, you can check out our guide to Thinkorswim charts.

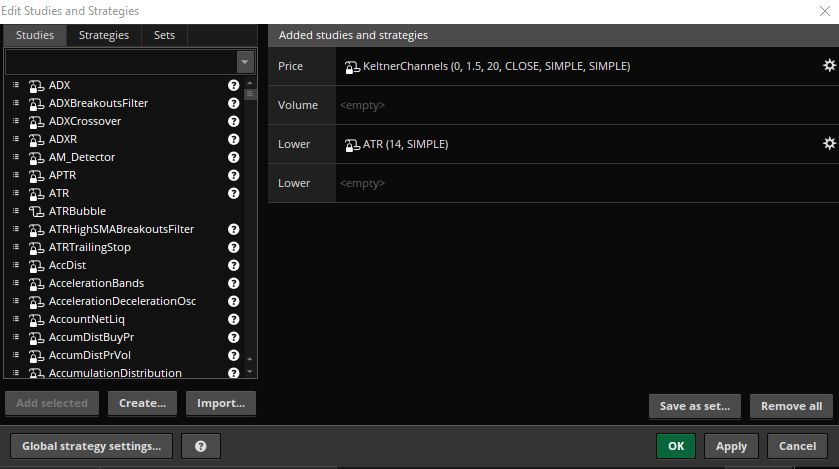

Plenty of Indicators and Studies

As far as the stock indicators and studies available in Thinkorswim, their offering is robust. They have an enormous amount to choose from, which makes their platform a great one for swing traders.

That image shows you just a portion of the studies that start with the letter "A", which gives you an idea of how many studies there are. They've got hundreds.

We found that Thinkorswim does a good job of catering to studies that may not be as well known and are therefore harder to find in other trading platforms. To our minds, it has one of the most extensive collections of studies available and is better than most trading platforms in that respect.

You can see our picks for the best Thinkorswim indicators by clicking here.

To see a full list of the studies available, you can check out our guide to Thinkorswim studies.

Customizable Scans

Thinkorswim's scanning tool allows users to filter and search for stocks based on specific criteria or studies.

For example, you could look just for stocks that are selling for less than $20 per share. Or you can look for stocks that have more than a million shares of trading volume on average in the last week.

You can also base scans on studies. For example, if you like to make investments based on the Relative Strength Index indicator, you can choose to scan for stocks using that study as a filter. This saves you the time of needing to manually flip through charts to find stocks that meet the criteria you're looking for.

Thinkorswim even allows you to write your own code for creating scans. They have a programming language you can use called thinkScript.

This is helpful if you have an algorithmic trading strategy and you want a scan that has specific but custom rules. We used this feature to create a custom scan that used Keltner Channels, for example.

After you run a scan, you can call the scan results into a watch list. That way you don't have to keep running the scan manually. It can auto-populate into one of the watch lists you create. It's a very cool feature that is not common in trading platforms.

You can see a watch list in that image, but it was auto-populated from a Thinkorswim scan. We did not manually put those tickers into that watch list.

OCO Orders

Thinkorswim allows for One Cancels the Other (OCO) orders, which is beneficial for some active traders.

OCO orders enable simultaneous setting of profit targets and stop loss orders. Many trading platforms don't offer this, which means that in those trading platforms, you can't have a sell order for both a profit target and stop loss at the same time. That creates more manual legwork for users to keep track of and manage their positions.

Thinkorswim's OCO orders have saved us a lot of time since it automates the whole process.

Responsive Email Support

In being active users of the Thinkorswim platform, we have needed to contact support on occasion.

We choose to do it through the contact page of the TD Ameritrade website. We have found their support team to be responsive to our emails about the Thinkorswim platform. We can't say the same thing about all other trading platforms we've used.

Thinkorswim Review: CONS

We are big fans of Thinkorswim, but there are some things that we didn't like or had trouble adapting to.

Here are features we didn't find to be user-friendly:

Different Versions for Desktop vs Mobile vs Web

Thinkorswim is available in different versions: Desktop, Web, and Mobile:

The desktop, web, and mobile versions of Thinkorswim have different interfaces, which can be challenging for users who are just getting started with any given version or who are switching between them.

It's really as if each version is a totally different software. This inconsistency may require additional time to adapt to each version.

Initially Overwhelming

The platform can be initially overwhelming and confusing for new users. Navigating through various windows and understanding the layout may require a learning curve.

For example, you have to go to the Charts tab to look at a chart. But from that tab, if you want to actually buy the stock you see on the chart, there isn't an obvious way to do it from that screen.

While customization is possible, creating custom layouts and enabling specific features may require time and effort. Users may need to invest in learning how to optimize the platform to their preferences.

We offer a free custom layout you can upload to get all the key features into one screen. You can upload that layout by going here.

Adding to the initial overwhelm is that certain features, such as being able to see current account positions, may not be immediately intuitive. For us, we expected it to be easy to see our account positions, but we found it hard to find them.

After we figured out how to get them displayed where we wanted them, and after we customized the layout, then we felt like we had everything we wanted at our fingertips. The learning curve was worth it in the end for us, but it wasn't an easy one to get through.

Thinkorswim Price Update Lagging

The platform's price data updates occur approximately every two seconds based on default settings.

For those who are doing longer-term investing or swing trading, that's perfectly fine and presents no problems.

For day traders or scalpers, though, split-second decisions are often needed, and that sort of data delay may not be acceptable. If you're the type of trader who is carefully watching Level 2 activity or Time and Sales activity, that data delay might make Thinkorswim unsuitable for you.

Fees

Thinkorswim is a great platform, but the fees that TD Ameritrade charges are not the cheapest in the land.

Their stock trades are commission-free, like most other major US brokers, but the commission fees for options trades and futures trades are on the higher end of the spectrum among brokers.

Learning More About Thinkorswim

You can contact us any time if you would like to ask any questions about Thinkorswim, or about anything related to trading in general.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.