Stocks With a Falling Wedge Chart Pattern Today

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

The stocks below are ones exhibiting a falling wedge chart pattern today according to our stock scanner. You can sort columns or add filters in order to fine-tune the scan results.

As of ---

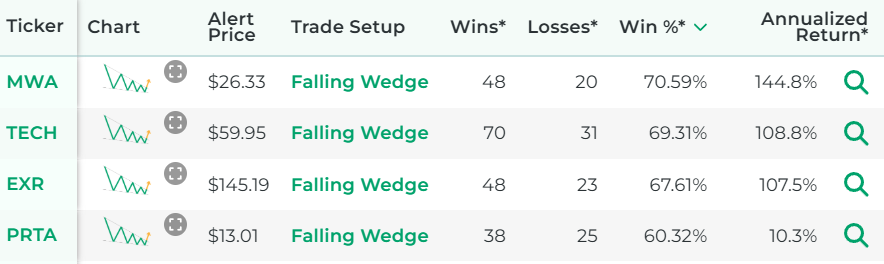

*Wins, Losses, Win Percentage, and Annualized Return are referring to how the stock performed in backtests for the Trade Setup indicated.

How to Use Our Scanner for Falling Wedge Stocks

The above list represents stocks that have falling wedge chart patterns today.

It's powered by our proprietary stock scanner, which searches once per day for stocks that have falling wedge patterns.

You can sort columns using the up and down arrows next to the column name. You can add filters for the column values by clicking the "Add Filter" button above the list of falling wedge stocks. This scanner is designed for active stock traders.

This video shows how to use our scanner:

Scanner Features that Require a Subscription

Our free scanner offers you the ability to find stocks that have falling wedge chart patterns, but you may need more than that to ensure you're making trades that have a true edge.

Our paid Swing Trading Service includes scanner features that are designed to offer you all the intelligence our research can offer. These are the scanner features you get if you pay for a subscription:

- See the historical backtested performance for each scan result. It looks like this:

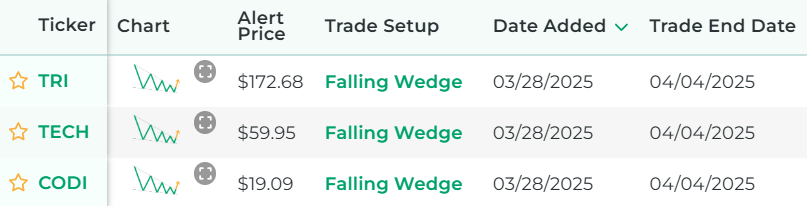

- See full trade setups for each scan result, including when to enter and exit. It looks like this:

- Get alerted when there are new scan results (by text or email).

- Get access to real-time scan updates throughout the trading day.

- Access scan results for all trading strategies in a single scan to easily see which trade setups have the best backtested performance across the entire market at any given time.

- Get access to scan results for our proprietary trading strategies, which required years of research to develop.

- Find Stock Trade Setups That Have a Backtested Edge

- Has DIY Swing Trading Scanner

- Get Swing Trade Picks from Our Scanner: 79.4% Average Annualized Return in Backtests

Here's a video that explains the difference between our free falling wedge scanner and the scanner from our paid service:

Stock Market Guides

Stock Market Guides identifies swing trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

79.4%

What Exactly Is a Falling Wedge?

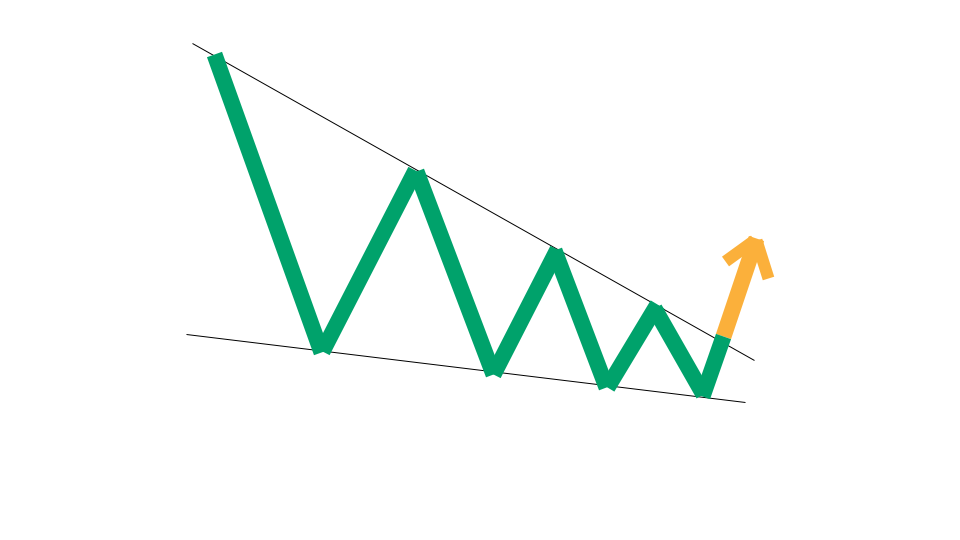

A falling wedge is a stock chart pattern characterized by two trendlines that converge to form the shape of a falling wedge. One is a downward sloping line of resistance along the top that connects the price peaks. The other is an upward sloping line of support along the bottom that connects the price troughs.

The upper and lower lines of the falling wedge pattern are not symmetrical. The upper line has a steeper slope than the lower line, so it has the appearance of an asymmetrical wedge that leans downward.

That image is a graphical icon that gives an idea visually of what a falling wedge chart pattern looks like.

How We Find Falling Wedge Stocks Each Day

Our one-of-a-kind scanning technology is at the heart of everything we do here. We have a way to program a trading strategy into our scanner, and then it uses real-time data feeds to find any stocks that meet the criteria of the trading strategy.

In the case of finding stocks that have a falling wedge pattern each day, our scanner looks for stocks that have two downward-sloping trendlines that are getting closer and closer together.

Our Criteria for Defining Falling Wedge Stocks

To find stocks that have falling wedge patterns, our scanner looks for stocks that have two downward-sloping trendlines. The top one has a steeper downward slope than the bottom one, which causes the distance between the two trend lines to narrow as time elapses.

Other Popular Scans at Stock Market Guides

Want to see scans we have for other popular indicators, chart patterns, and candlestick patterns? Check them out here:

Have Questions About Falling Wedge Stocks or Our Services?

If you have questions about stocks with falling wedge patterns or questions about any services we offer, you can contact us any time and we'll be ready to help.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.