Best Swing Trading Strategies, According to Stock Market Research

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

Swing trading offers the potential for generating profits in the stock market, but it comes with risk. Knowing the best swing trading strategies could be the difference between making money and losing money.

Swing trading is a form of active stock market investing that involves holding a position for days or weeks. It's popular because it involves more active trading than buy-and-hold investing. Some find it more enjoyable due to the extra action, and many feel it offers the possibility for more profit.

Swing trading is less active than day trading, making it a good fit for people who have existing jobs and want to earn supplemental income.

The key is to ensure you're using the right strategies, which is why we're here. You could use a stock picking service to help you with your swing trade decisions, but if you want to learn the strategies on your own, you can do that here.

We've researched more than 20 years of historical stock price data, and we've come up with swing trading strategies with a historical track record of success in backtests.

To our minds, there is no better trading strategy than one that might put the odds of profitability in your favor. So that's the focus of this guide. The best profit odds make for the best strategies.

Components of Swing Trading Strategies

Before we get into the strategies themselves, let's talk about the components of a swing trading strategy.

Stocks or Options

When you want to make a swing trade, you can choose which vehicle to use.

You can buy stocks and use shares of stock as your mechanism for making the trade. Stocks can be purchased using any stock trading app.

You can also buy options that generally correlate with stock prices. Options have more leverage than stocks, which means they can offer more potential rewards and risks.

Buy or Short

There are ways to benefit from a stock price going either up or down. If you buy stock or "call" options, you typically benefit when the stock price goes up.

If you short stock or buy "put" options, you typically benefit when the stock price goes down.

You can use swing trading strategies that incorporate any of those. The most popular swing trading strategies are ones that involve buying stock.

Trade Time Frames

When you make a swing trade, you hold it for anywhere from a few days to a few months.

Ultimately it's up to you how long you hold a position. If you want to be active, you can quickly churn through trades and take on new positions every week.

If you prefer less action than that, you can hold positions for weeks or months.

Some swing trading strategies have a deteriorating rate of return the longer you hold the position.

That means there might be more net profit potential if you hold the positions for a relatively short period, such as a week, and then cut the cord to get into new positions.

Trade Entry Points

A crucial part of any swing trading strategy is knowing when to enter the trade. We'll discuss that below for each strategy we outline.

Trade Exits

With the swing trading strategies we feature in this guide, the exits can be flexible according to the research we did. That means you can choose which exit to use for yourself, and it still could fall within the zone of the backtested edge.

The two primary types of exits are:

• Profit Target: This is when you lock in your profit. You do it because your profit on the trade reached your target level.

• Stop Loss: This is when you pull the plug on your position because you don't want your losses to grow more extensive on the trade.

The strategies we feature don't have rigid rules about the profit target and stop loss. For example, you can use a tight profit target or have no profit target at all. Similarly, you can lock in profits quickly or let your winners keep running.

Every combo of exits we tested looked favorable in the research we did.

Swing Trading Risk

No swing trading strategy description is complete without mentioning the risk involved. Just because stock research suggests these strategies may have been some of the best historically, that doesn't mean they are guaranteed to be profitable in the future.

Also, our research is all geared toward looking at long-term odds. Even if these are the best swing trading strategies out there, they will inevitably have periods where the losses outweigh the gains. Swing trading carries legitimate risk.

With that important disclaimer out of the way, on to the strategies!

Stock Market Guides

Stock Market Guides identifies swing trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

79.4%

The Trend Might Be Your Friend for Swing Trades

A famous saying among swing traders is, "the trend is your friend." If the stock price has been consistently going in one particular direction, don't fight it.

For example, if you're looking at Apple stock and the price has been going upward consistently over the last few weeks, that is considered an uptrend.

If you were to short Apple stock for a swing trade at that point, you would be fighting the trend. The stock is trending upward, so shorting it would mean you're expecting the price to go against the trend and go down.

Many swing trading strategies are based on this concept. Entry points for trades may vary and involve other criteria, but the core foundation of many strategies is that the stock price needs to trend in one direction or another.

Swing Traders Often Like Pullbacks

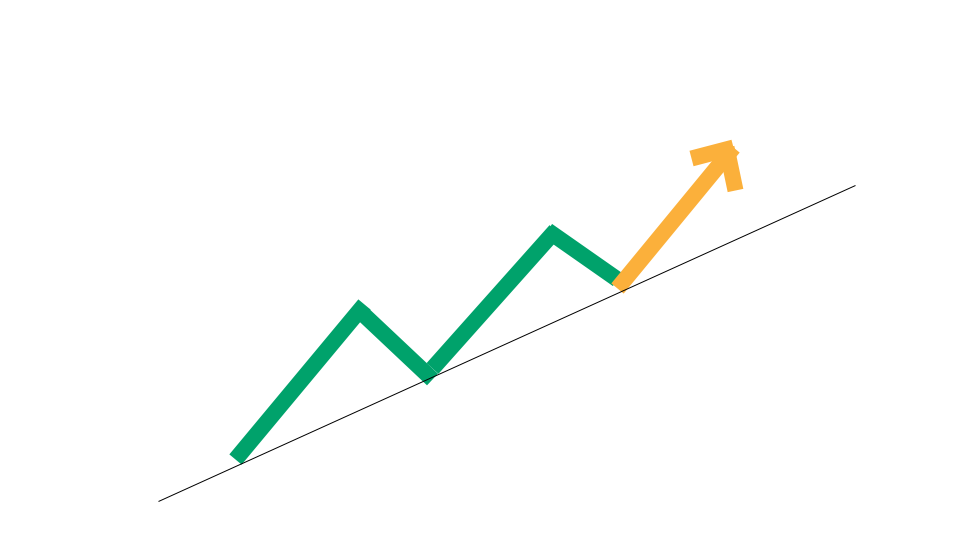

A pullback is when a stock price has been trending upward, then it comes down for a bit.

The pullback can be gentle or sharp. But the key characteristic is that the stock price has been trending upward, and then it reverses course for anywhere from a day to a handful of days. It might look like this on a stock chart:

You can see in that image how the price had been going up starting from the left side of the chart, and then toward the right side of the chart it started going down to some degree.

That pullback presents an opportunity to take a trade that often has a backtested edge. In other words, buying pullbacks might put the odds in your favor of making a profit on your swing trades.

You could jump into the trade early in the pullback. Or you could wait for it to become a deep pullback. Both have had success historically, according to back tests.

We put together a complete pullback trading strategy that lays out specific ideas for an entry and exit for the trade.

Keltner Channels and moving averages can be helpful for identifying when stocks are trending. You can use those indicators to confirm your perception of the trend any given stock is exhibiting.

We also put together a complete Keltner Channel trading strategy, which is another way of capitalizing a stock pullbacks.

You may wonder whether taking pullback trades goes against the "trend is your friend" idea. After all, buying a pullback means buying at a time when the stock price is coming down.

The answer is that for the trend, you're looking at the bigger-picture trend that's reflected over the last few weeks. You're zooming out your perspective to identify the trend.

On the other hand, the pullback occurs over a handful of days. A stock can have several pullbacks within a period that is an uptrend overall. People can capitalize on that by employing the pullback trading strategy.

How Do You Find Stocks That Have Pullbacks?

You can find them by using our Pullback scanner. It's a free tool we offer here at Stock Market Guides. It uses our proprietary scanning technology to find stocks that have pullbacks.

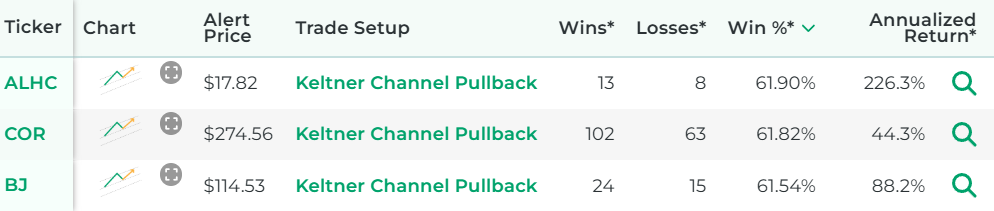

Here's how the scanner results look:

How Well Do Pullback Trades Perform?

We did backtests and determined which pullback settings may have been most profitable historically.

We also studied which stocks responded best to pullback trade opportunities.

Here is some data that shows how a proprietary pullback trading strategy we created has performed historically according to backtests:

Wins

---

Losses

---

Win Percentage

---

Annualized Return

---

Anyone who signs up for our swing trading scanner service will be able to see stocks that qualify for that trading strategy in real time.

Buying Above Support

The word "support" is a pretty common term among swing traders. By definition, it refers to a swing low. That's when the lowest price for a given day is lower than the lowest prices for the days surrounding it (the day before and the day after).

Its chart pattern looks like an inverted mountain top when you look at a stock chart. Here's a one of our stock charts that shows a support level:

The yellow line on that image indicates the support level. It connects the price bar where the support level was first established and the most recent bar, which is now near that same price level.

Each swing low is considered a form of support. There might be buyers lined up at that price level ready to buy since there were buyers at that price level before who turned the price momentum around.

The theory is that the more pronounced the swing low, the better the odds of the support holding up. In general, when you look at a stock price chart, the swing lows should jump out at you for them to be meaningful.

This swing trading strategy involves buying a position right above the swing low price. It's like taking on a trade before the potential support level is reached in hopes of riding the wave up if other buyers step in at support.

Our research suggests that this strategy might work best when the stock is already trending upward.

How Do You Find Stocks at Support Levels?

You can find them by using our Support Level scanner. It's a free tool we offer here at Stock Market Guides. It uses our proprietary scanning technology to find stocks at their support levels.

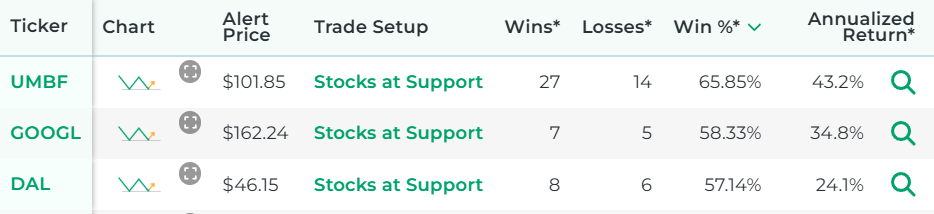

Here's how the scanner results look:

Performance of Support Level Strategies

We did backtests and determined which support levels may have been most effective historically.

We also studied which stocks had the best results with using support levels.

Here is some data that shows how a proprietary Support Level strategy we created has performed historically according to backtests:

Wins

---

Losses

---

Win Percentage

---

Annualized Return

---

Anyone who signs up for our swing trading scanner service will be able to see stocks that qualify for that trading strategy in real time.

Buying Oversold Stocks

An oversold stock is one that has seen a major price reduction recently.

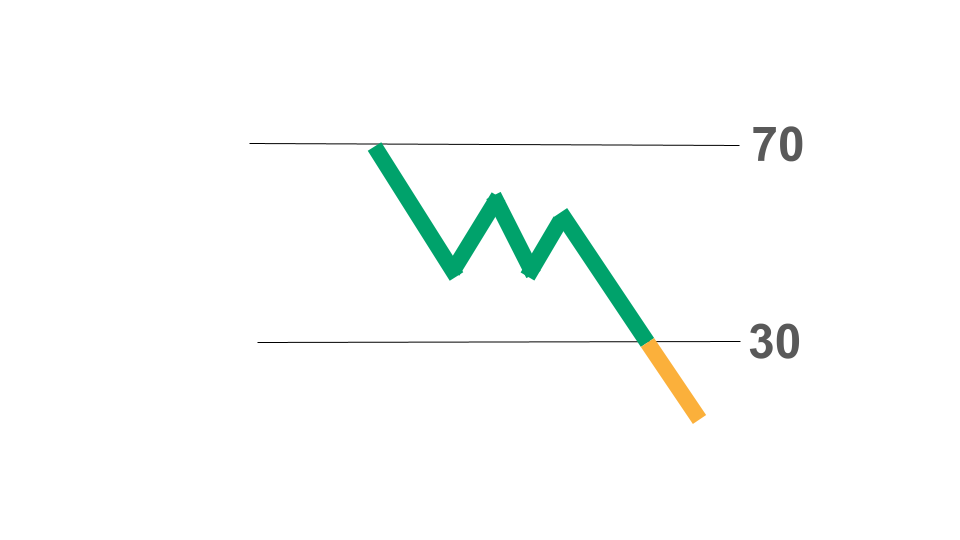

To determine if a stock is oversold, a trader will typically look at a stock indicator called RSI.

The RSI Indicator has a value that ranges between 0 and 100. A stock's recent price history determines its RSI value.

An RSI value of 30 or below indicates the stock is oversold. An RSI indicator looks like this in many trading platforms:

The idea behind an oversold stock is that the selling pressure might have been excessive and caused the price to go below its fair value. The stock might therefore be due for a rebound in price. This is particularly attractive to swing traders, who look for short term opportunities to see a big change in price.

It's also nice for short term traders because it offers such a simple trade criteria. You're simply waiting for the RSI value to go below 30.

How Do You Find Oversold Stocks?

You can find them by using our Oversold Stocks scanner. It's a free tool we offer here at Stock Market Guides. It uses our proprietary scanning technology to find stocks that are oversold.

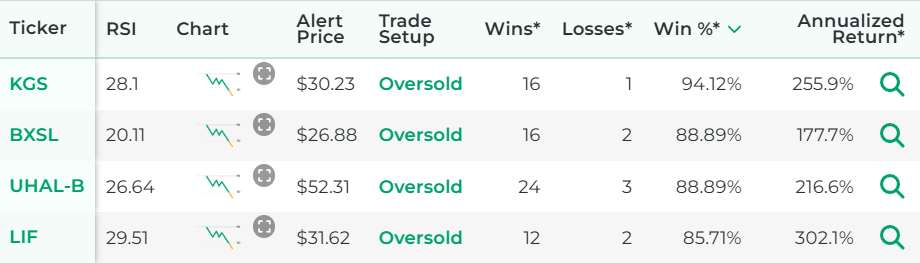

Here's how the scanner results look:

Performance of Oversold Strategies

Here is some data that shows how a proprietary oversold stocks trading strategy we created has performed historically according to backtests:

Wins

---

Losses

---

Win Percentage

---

Annualized Return

---

Anyone who signs up for our swing trading scanner service will be able to see stocks that qualify for that trading strategy in real time.

Momentum Swing Trading Strategy

The last three strategies discussed buying stock or options as the price drops.

This one is about buying a stock when its price is on the move upward. It is a momentum trading strategy.

The key is knowing when to buy, and that's where our research might help.

We found a backtested edge for swing trades when a stock spikes up in price after having been relatively dormant in the prior weeks. Its stock chart might look a little like this:

So you're looking for a stock that's been in a sleepy range for a while. It then has a day with a big upward move. There may be an edge to buying the stock for a swing trade at that point.

It's like catching the stock right after it's initiated liftoff.

How Do You Find Momentum Stocks?

You can find them by using our Momentum Stocks scanner. It's a free tool we offer here at Stock Market Guides. It uses our proprietary scanning technology to find momentum stocks.

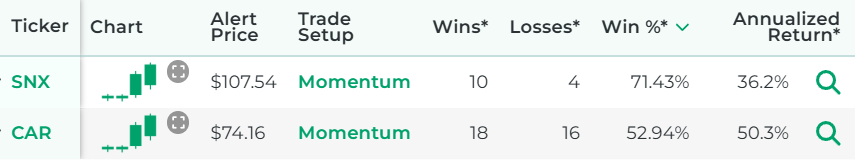

Here's how the scanner results look:

Performance of Momentum Strategies

Here is some data that shows how a proprietary momentum stocks trading strategy we created has performed historically according to backtests:

Wins

---

Losses

---

Win Percentage

---

Annualized Return

---

Anyone who signs up for our swing trading scanner service will be able to see stocks that qualify for that trading strategy in real time.

Help With Swing Trading

This strategy guide laid out the best swing trading strategies we know.

Some of you might feel like you've got what you need and are off to the races. Others may still need a little more help to put this all into action. If some of the information from this guide went over your head, consider joining a stock trading course.

Or you may understand the strategies but want an easy way to find these trades in real time. That's where a swing trading scanner might help you out.

Or maybe you want to do as little work as possible and have a pro do all the work for you. Our swing trade picks service sends alerts to you when our scanner finds a trade setup that has a strong backtested edge.

Wrapping It Up

If you're looking for the best swing trading strategies, you're looking for the ones that make the most profit. And to figure out which ones those are, it helps to look at history and see what the data shows us.

The swing trading strategies we presented in this guide are all ones that are supported by the historical stock price research we did.

If you use strategies that align you with the direction of the trend, then you might be putting the odds in your favor.

You can contact us any time if you would like to ask any questions about swing trading strategies or anything else related to the stock market.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.