PE Ratio - How It Works and How Investors Can Use It

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

When it comes to the stock market, sometimes you might hear the term "PE ratio" mentioned. It refers to a fundamental analysis metric that is popular among active stock traders.

This article will explain what a PE ratio is and how investors might be able to benefit from using it.

What Exactly Is a PE Ratio?

PE ratio (or P/E ratio) stands for Price-to-Earnings ratio. It's a fundamental valuation metric used in the stock market to evaluate a company's stock price relative to its earnings.

It’s calculated by taking the current share price of a company's stock and dividing it by its earnings per share (EPS).

The formula looks like this:

PE Ratio = (Current Share Price) / (Earnings per Share)

Here is a breakdown of the components of the calculation:

Current Share Price: This is simply the current price of the company’s stock at any given moment.

Earnings Per Share (EPS): This takes the earnings of the company over the last 12 months (as of the company's most recent quarterly financial report), and divides it by the total shares outstanding for the company. The company's earnings can be found on its income statement, and the company's outstanding shares can be found on its balance sheet.

The calculation above is the classic way to compute a company's PE ratio. It's also referred to as a trailing PE ratio since it's looking at historical earnings (actual earnings).

Companies also project earnings, and there is a metric called a forward PE ratio that uses projected earnings as the basis for the calculation.

Stock Market Guides

Stock Market Guides identifies stock investing opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

43.1%

Why Does a PE Ratio Matter?

PE ratios can be seen as a metric to gauge how attractive the price of a stock is at any given time.

Earnings, or profits, are a cornerstone of any company's financial health and are often referred to as the "bottom line" since they can be found at the bottom of a company's income statement.

Many people feel that a company's value lies in its ability to generate earnings, since earnings represent the net incremental economic benefit a company is creating.

The PE ratio looks at a company's stock price and compares it to those earnings.

A low PE ratio suggests that the stock price might be relatively discounted compared to the value of the earnings it generates.

A high PE ratio suggests that the stock price might be relatively expensive compared to the value of the earnings it generates.

The PE ratio is a popular metric among value investors, who typically look to "buy low" on solid established companies.

How Do You Find Stocks With Low PE Ratios?

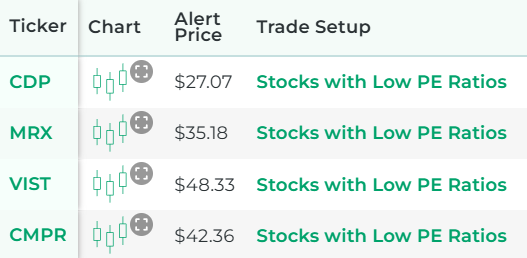

You can find them by using our Low PE Ratio scanner. It's a free tool we offer here at Stock Market Guides. It uses our proprietary scanning technology to find stocks that have low PE ratios.

Here's how the scanner results look:

That tool ensures that you don't have to waste time flipping through stock profiles manually to find stocks with low PE ratios.

Limitations of the PE Ratio

As is often the case, making an investing decision based on a single metric without any context may not be effective. As helpful as the PE ratio might be, it has some limitations to consider.

Different industries have different typical PE ratios.

In terms of determining which PE ratios qualify as "low", it might be helpful to look at the PE ratios of others in the same sector.

Earnings can be manipulated through accounting practices.

Even though companies in the stock market have to abide by specific accounting rules (referred to as GAAP standards), they still have some degree of flexibility in how to report some financial activities. In some cases, this could affect the reliability of the reported earnings figures.

Growth companies' valuations may not be driven by past earnings.

Companies with higher growth rates often have higher PE ratios because investors are willing to pay a premium for expected growth. The higher PE ratio of those companies doesn't necessarily mean they offer poor value for the investor.

Example of a PE Ratio Investing Strategy

For this example of a PE ratio investing strategy, we're going to look for stocks with low PE ratios and plan to hold them for up to a year.

In particular, we'll look for stocks with a PE ratio below 10. That value is considered by many to reflect a low PE ratio, regardless of industry.

Our research suggests this simple strategy might have a track record of success.

Entry for the PE Ratio Investing Strategy

The entry for this PE Investing strategy will be as follows:

The entry criterion for our PE Ratio investing strategy is very simple.

We included the requirement that the PE ratio be greater than zero to avoid companies that have negative earnings. When looking for a good value investment, we want one that's got positive earnings.

Exit for the PE Ratio Investing Strategy

There are a lot of possibilities here for the exit.

For any given investing strategy, it can be helpful to define two different criteria for the exit: a profit target and a time limit.

Not everyone sets exit criteria for a long-term investment, and that's totally fine. Ultimately, you are in charge of your investments, and you can manage them any way you want. But for the purposes of this investing strategy example, we will define them:

- Profit Target

We will set a profit target that would reflect a 30% gain if the position were to be sold at that price.

In other words, we will take the price we paid for the stock at entry, multiply it by 1.3 (which effectively adds 30%), and use that to set up a sell limit order as a profit target.

If the sell limit order gets filled before the time limit is reached, then our investment is complete, and we will have realized a 30% return on investment.

- Time Limit

We will set the time limit as one year. If the stock has not hit the profit target within one year of the date of stock purchase, then we can close the trade manually at the stock's prevailing price.

How Well Do Low PE Ratio Investments Actually Work?

The idea of a low PE ratio investing strategy sounds nice to many people because it offers a clear, easy-to-understand way to find an investment idea.

But does it actually work? Can traders indeed generate profits from buying low PE ratio stocks?

That's exactly what our company can help answer for you, since our scanner technology has allowed us to do our own research on that precise question.

The answer is that investments based on low PE ratios are not always profitable, but for certain stocks they might indeed have a track record of success according to our backtest research.

Here is some data that shows how a proprietary low PE ratio investment strategy we created has performed historically according to backtests:

Wins

---

Losses

---

Win Percentage

---

Annualized Return

---

Anyone who signs up for our stock scanner service will be able to see stocks that qualify for that trading strategy in real time.

Learning More About PE Ratios

You can contact us any time if you would like to ask any questions about PE ratios or anything else related to the stock market.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.