What is Swing Trading and How Can People Profit From It?

Stock Market Guides is not a financial advisor. Our content is strictly educational and should not be considered financial advice.

For anyone who has investigated ways to make money in the stock market, they might have heard the term "swing trading" mentioned.

This article will explain what swing trading is and how people might be able to make money from doing it.

What Exactly is Swing Trading?

The definition of swing trading is as follows:

When it comes to stock market investing, you have a choice of how long to own a stock. Swing trading falls in between day trading, which involves owning each stock for less than a day, and buy-and-hold investing, which typically involves holding a stock for three months or more.

In other words, swing trading is synonymous with "active stock trading", but it's not so active as to be buying and selling a position in less than a day.

Decisions about which stocks to swing trade are typically based on technical analysis. This means that instead of buying a stock based on how the company is performing financially, known as fundamental analysis, a decision to buy a stock is instead based on things like chart patterns, stock indicators, and candlestick patterns.

Stock Market Guides

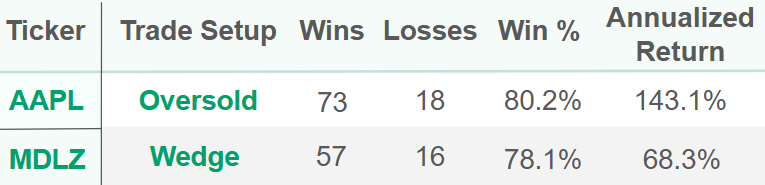

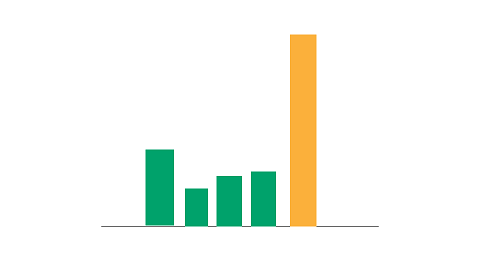

Stock Market Guides identifies swing trading opportunities that have a historical track record of profitability in backtests.

Average Annualized Return

79.4%

Is Swing Trading Easy?

Swing trading might be considered relatively easy in some ways and relatively hard in others. Here is a breakdown:

Administering Trades

In terms of the nuts and bolts of buying and selling stocks, swing trading might be considered relatively easy once you get through the learning curve.

To perform a swing trade, you simply buy a stock one day and sell it at least one day later. All you need is a trading platform or brokerage account to do it.

If you are new to stock trading, you can check out our guide to buying stocks for beginners.

Finding an Edge

Making swing trades that give you an actual profitable edge is where swing trading become substantially challenging.

How do you know which stock trades to make? How do you know how long to hold each trade before selling it?

There are seemingly countless ideas for how to determine which stocks to buy, but it can be very hard to tell which are valid ideas that give you bonafide edge. That makes swing trading difficult.

We have a service here at Stock Market Guides that is intended to make this aspect easier for people. Our proprietary scanner not only finds trade setups, but it also calculates how each one performed historically according to our backtesting process.

This image above is an example of the output you might see from our scanner. This allows you to see the historical track record of a trade setup before deciding whether to buy a stock or not. You can learn more about that service by checking out our swing trading scanner.

Trading Psychology

Imagine you know how to buy and sell stocks and you also are using a swing trading approach that has a bonafide edge and puts the odds in your favor of making profit over time.

There is still another aspect of swing trading that can be challenging for many people: trading psychology. This refers to your state of mind while trading.

What many swing traders find is that when they have a losing trade, it can be hard to endure mentally. Emotions like fear or anger can come up, and they can derail your trading plan.

This poses a challenge because even the very best swing trading strategies still involve losing trades. There is no trading strategy that exists that will earn you a profit on every single trade.

So learning to endure a loss might be a key part of becoming a successful swing trader. It's challenging because there is very real risk involved.

Video About Swing Trading

Here's a video where we talk about what swing trading is and use a real stock chart for Amazon to show some examples of what a swing trader might be trying accomplish:

Swing Trading Strategies

There are a multitude of swing trading strategies to consider. They're typically based on technical analysis. Here is a breakdown of some popular ones:

Chart Patterns

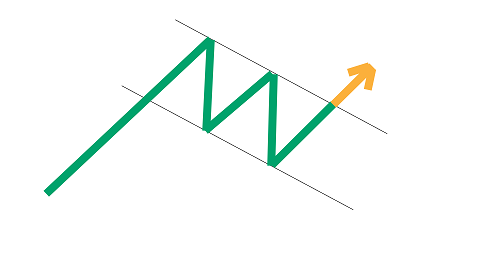

Chart patterns are often considered by swing traders when it comes to trading strategies.

The patterns seen on a stock chart can reflect changes in buying and selling pressure. These patterns might sometimes give swing traders a way to put the odds in their favor of identifying where the stock price will go next.

Examples of popular chart patterns include:

We have a chart patterns guide that shows you a variety of chart patterns that are popular among swing traders.

Stock Indicators

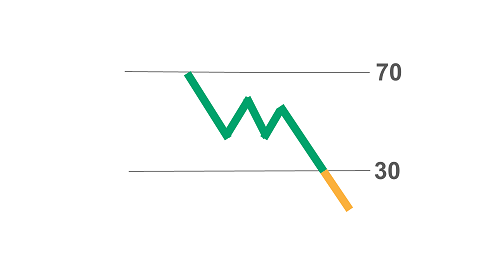

Stock indicators are another popular basis used for swing trading strategies.

Stock indicators are typically mathematically-derived metrics that give you information about the stock. For example, they can give you information about how quickly a stock's price has changed or what the average price of a stock is over a given period of time.

These metrics can then be used to determine when a good swing trading opportunity might exist.

Examples of popular stock indicators include:

We have a stock indicators guide that shows you a variety of stock indicators that are popular among swing traders.

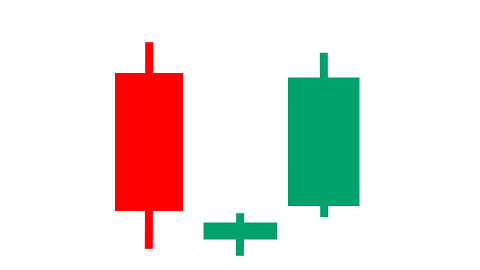

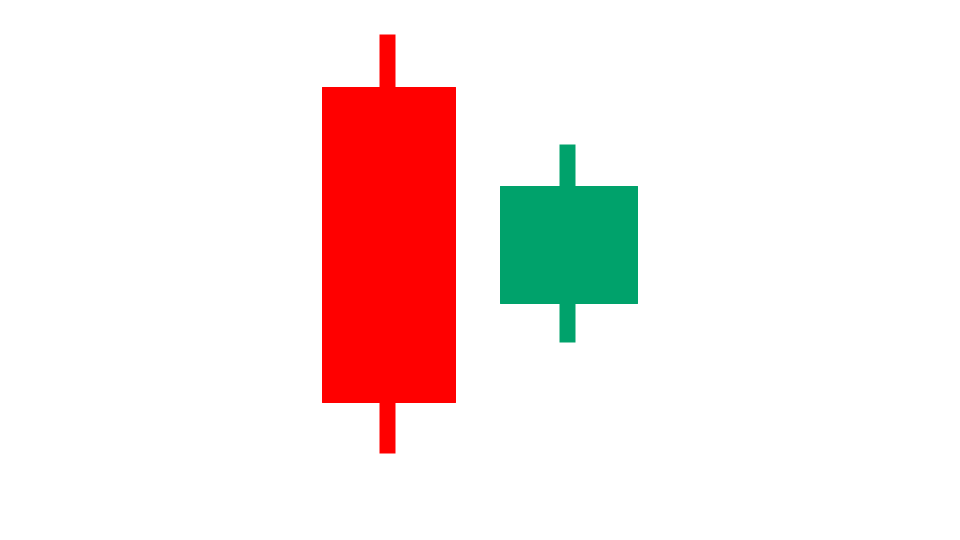

Candlestick Patterns

Candlestick patterns are also used by some swing traders as a basis for their trading strategies.

Candlesticks are the price bars that you see on a stock chart. Sometimes these price bars might reveal information about buyer or seller sentiment that could give a swing trader clues about where the stock price might be headed next.

Examples of popular candlestick patterns include:

We have a candlestick patterns guide that shows you a variety of candlestick patterns that are popular among swing traders.

How Can People Profit from Swing Trading?

Over the long term, in order to profit from swing trading, a person needs to be trading with an edge. This means that when they make trades, the odds need to somehow be in their favor for making a profit.

It doesn't mean that they need to win every trade, though. Even if you had an edge where you won just 55% of the time, that could equate to substantial gains over time. This video explains how.

The question, then, is how to you get a trading edge that puts the odds in your favor?

To our minds, the answer is in the data. Swing trading is all about patterns and indicators, which are quantifiable and data-driven.

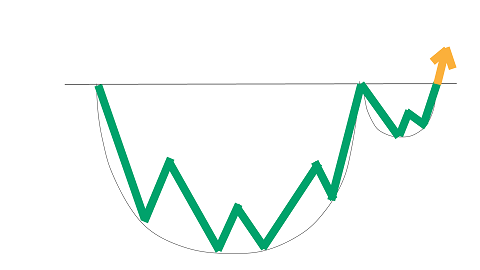

So if Tesla stock shows a Cup and Handle chart pattern, as shown above, we think that before deciding whether to buy the stock, it's best to know how many times that chart pattern has shown up before for Tesla stock, and how it performed in those cases.

That's what our scanner technology offers. It not only find these swing trading chart patterns in real time, but it also quantifies how successful they've been historically for each stock according to our backtest research.

We think this might improve peoples' odds of swing trading with an edge. If you're only taking trade setups that have a track record of success, it might noticeably improve your odds of trading profitably.

Risk Involved with Swing Trading

With swing trading, by definition, you will be holding positions overnight. That means you are exposed to the risk of price movement of your positions overnight.

This overnight risk is called gap risk. In some cases, holding a stock or option position overnight could lead to substantial losses.

For example, say you buy shares of Apple stock. After the market closes, imagine that Apple announces earnings and it's a bad earnings report.

That could cause the price of Apple stock to drop substantially overnight, and by the time the market opens the next day, your Apple position could have lost a lot of value.

Although you have gap risk with swing trading, sometimes taking that risk can offer a nice reward. We've done research that suggests that over the last few decades, stock prices have gone up overnight by more than they've gone down.

So there might be a justified reason to embrace the gap risk involved with swing trading. But it's a genuine risk, and each trader has to decide what level of risk they feel comfortable taking.

Time Required for Swing Trading

Swing traders spend time researching stock trade opportunities, but swing trading does not require a person to sit in front of the computer screen all day.

The reason is that swing traders are holding their stock positions for multiple days or even weeks. With that being the case, there are only a limited number of new trades a swing trader can take on each day.

Many swing traders have full time jobs and fit their trading activity in around their work schedule.

When it comes to the time needed for swing trading research, our services at Stock Market Guides might be able to help you.

You can sign up for a swing trade alert service. The service will do the research and notify you when a trade opportunity comes up. All you have to do is decide whether to administer the trade.

Can Swing Trading Be Done for Both Stocks and Options?

In this article, we've talked about swing trading stocks, but swing trading can also apply to other assets in the stock market, such as options and futures.

Options, in particular, are directly tied to stocks. As a result, if someone does technical analysis on a stock to find a swing trading opportunity, they can decide which vehicle to use to carry out the trade: shares of the stock itself or options that are tied to the stock.

How Does Swing Trading Differ from Day Trading?

Both swing trading and day trading are forms of active stock trading. The key difference between them is that day trading involves holding positions for one day or less, while swing trading involves holding positions for more than a day.

There are other differences between them related to risk and time investment. You can learn more detail by reading our guide to swing trading vs day trading.

Learning More About Swing Trading

You can contact us any time if you would like to ask any questions about swing trading or about anything else related to the stock market.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.