Get Live Trade Setups That Have a Backtested Edge

Our scanning technology uses historical statistics to help you make profits in the stock market.

Our One-of-a-Kind Scanner

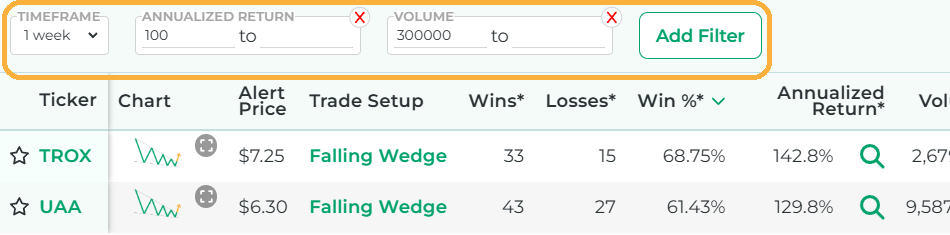

Our proprietary scanning software is at the heart of everything we offer. It can find trade setups for stocks based on everything from chart patterns to PE ratios. Our scanner finds these trade opportunities in real time and caters to both stocks and options.

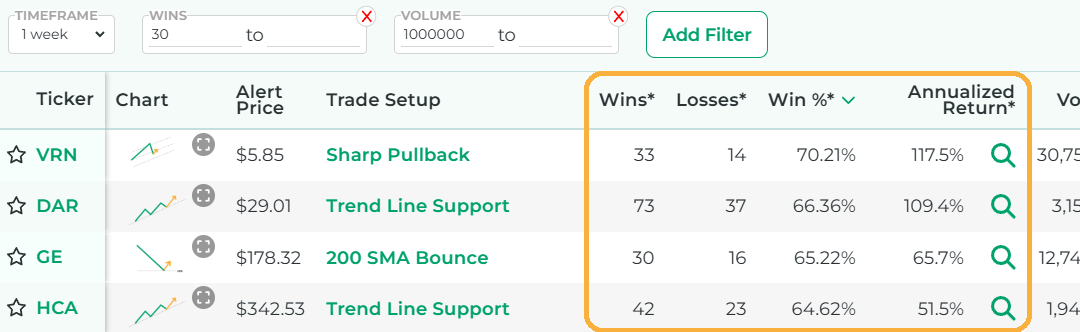

Our Special Sauce: Backtest Results for Each Trade Setup

Our scanner shows the historical backtested track record of each trade setup it finds, including wins, losses, and return on investment. This is what sets our service apart. Why act on a trade setup if you don't know its track record of success?

Our Services

We have do-it-yourself scanner services as well as done-for-you trade alert services.

DIY Scanner Services

Use our scanner to do your own research and analysis to find trade ideas. Filter scan results to ensure you're only considering the most prime trade setups.

For Buy-and-Hold Investors

Uses Fundamentals Like:

* Earnings

* Sales

* P/E Ratios

For Active Stock Traders

Uses Technicals Like:

* Chart Patterns

*Stock Indicators

* Candlestick Patterns

For Option Traders

Uses Technicals Like:

* Chart Patterns

*Stock Indicators

* Candlestick Patterns

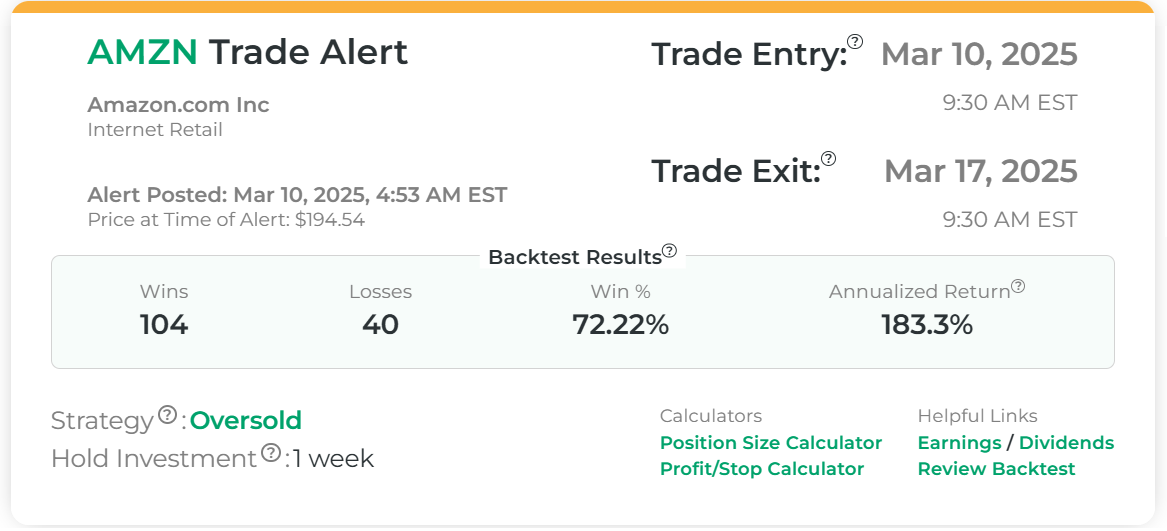

Stock and Option Picking Services

Our scanner picks trades for you. You can sit back and let us do all the work to determine which trade setups are worth your attention. Get trade alerts each time our scanner makes a new pick.

Popular Scan Types We Offer

You can use our free scanner to find a variety of different types of stock and option trading opportunities. You won't be able to see the historical performance of each scan result unless you sign up for our paid service.

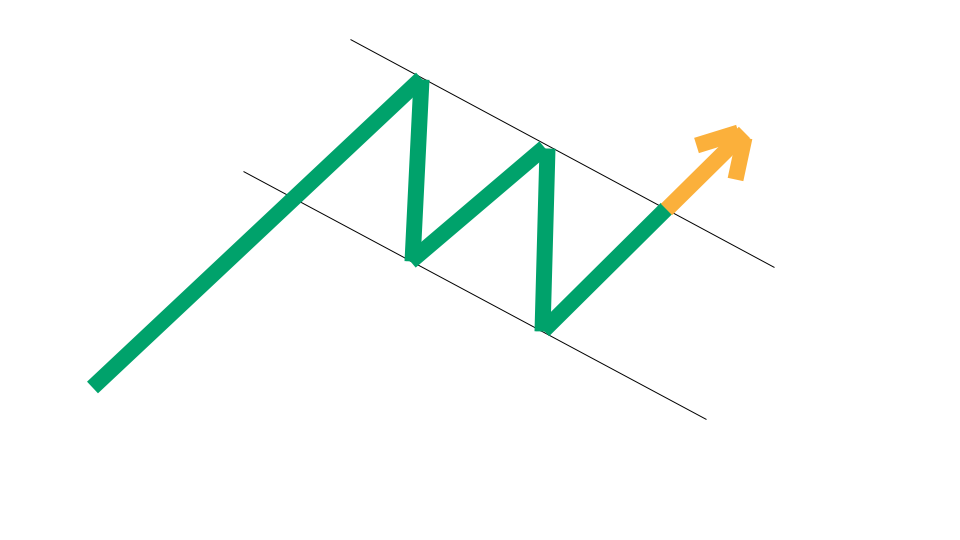

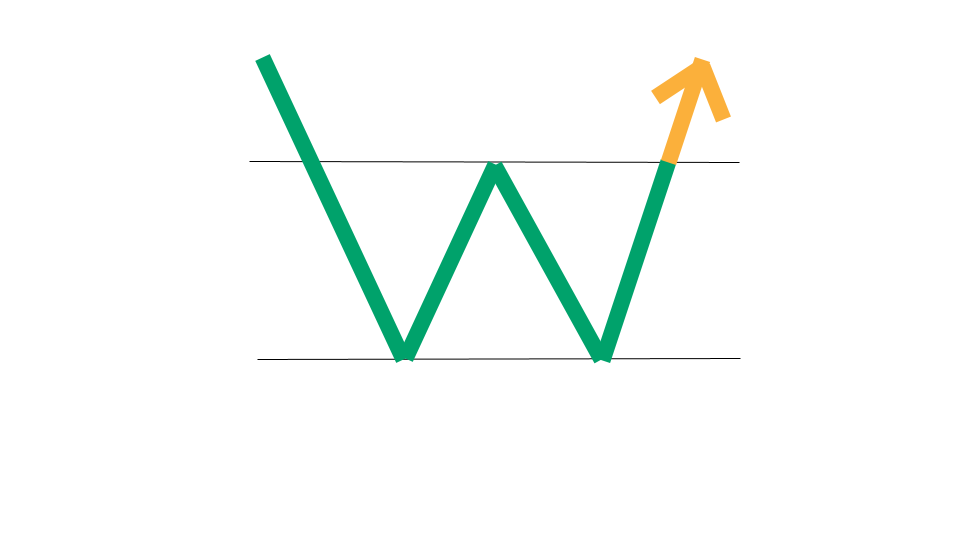

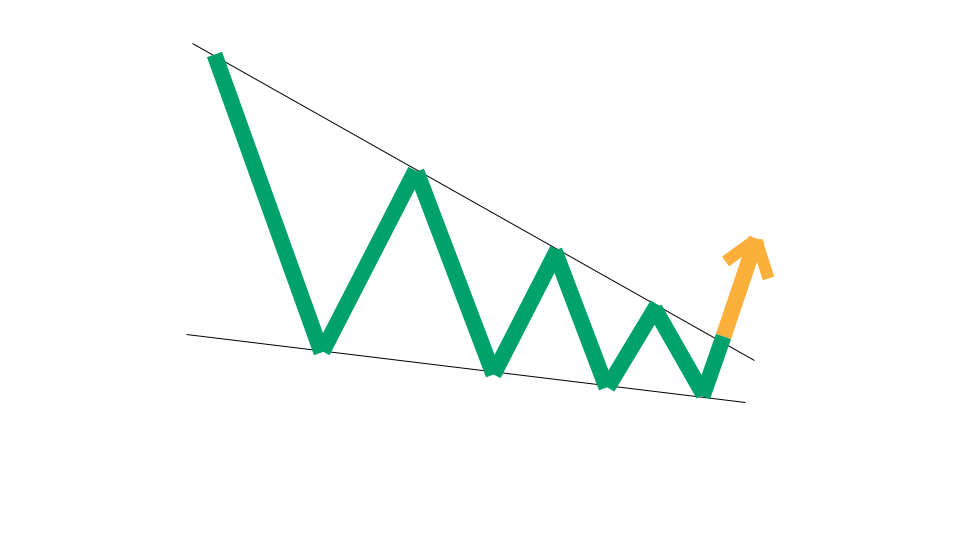

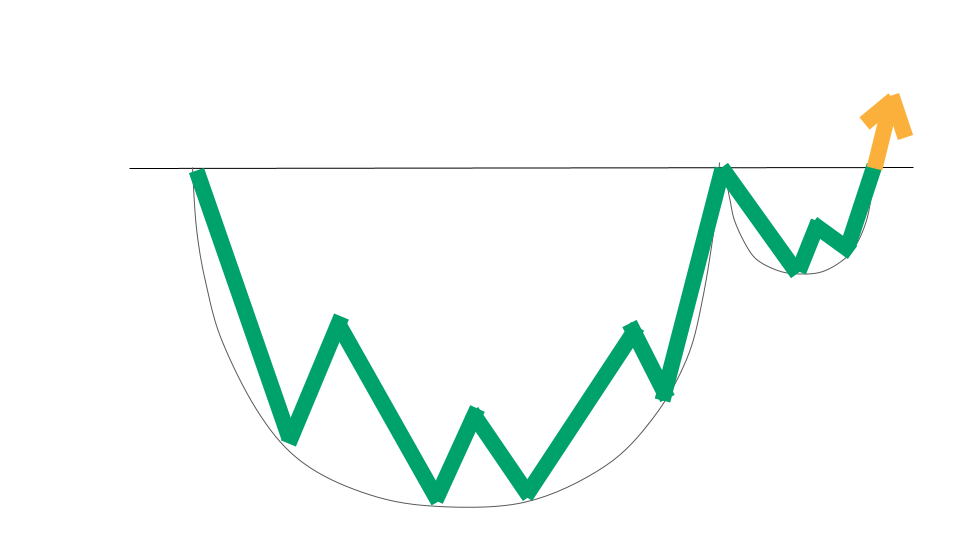

Chart Pattern Scanner

Our scanner finds stocks exhibiting the following popular stock chart patterns:

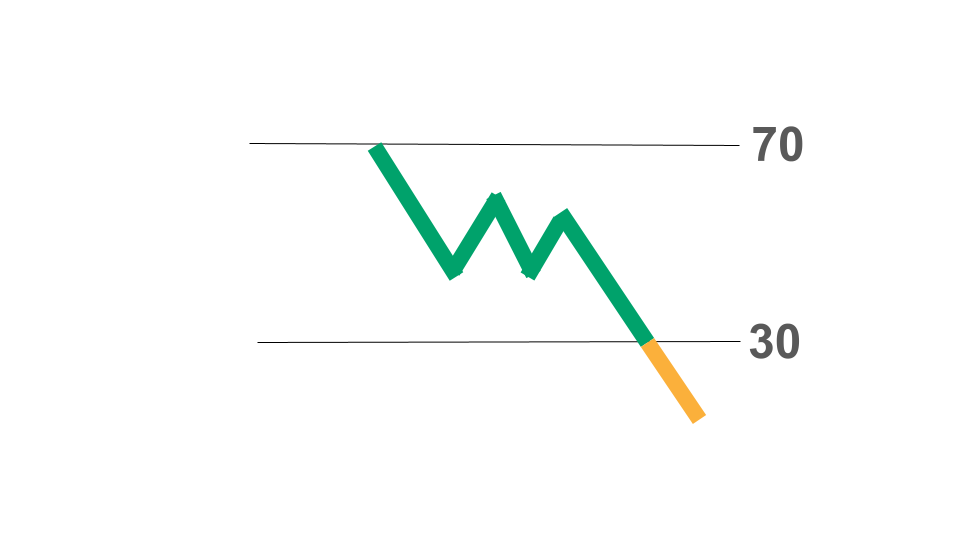

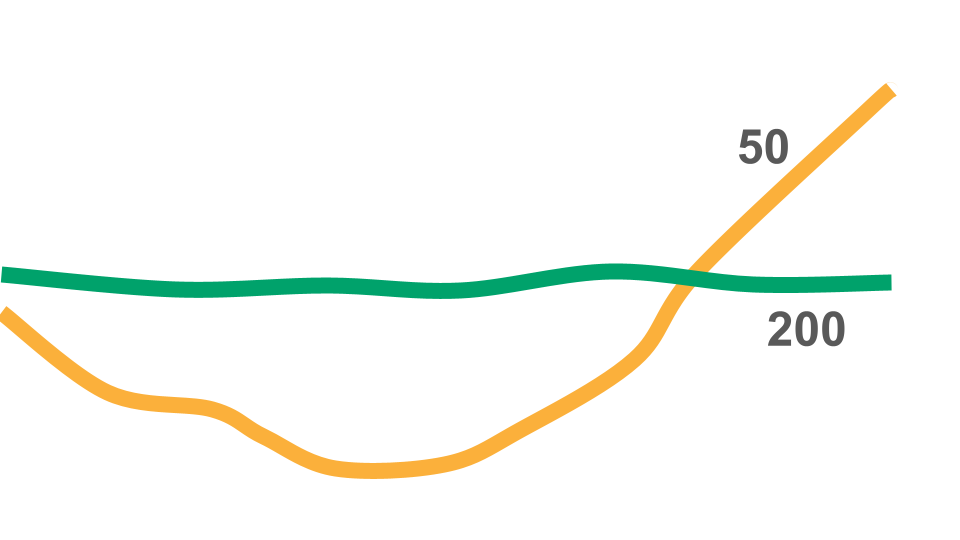

Stock Indicator Scanner

Our scanner finds stocks based on the following popular stock indicators:

Stock Fundamentals Scanner

Our scanner finds stocks based on the following stock fundamentals:

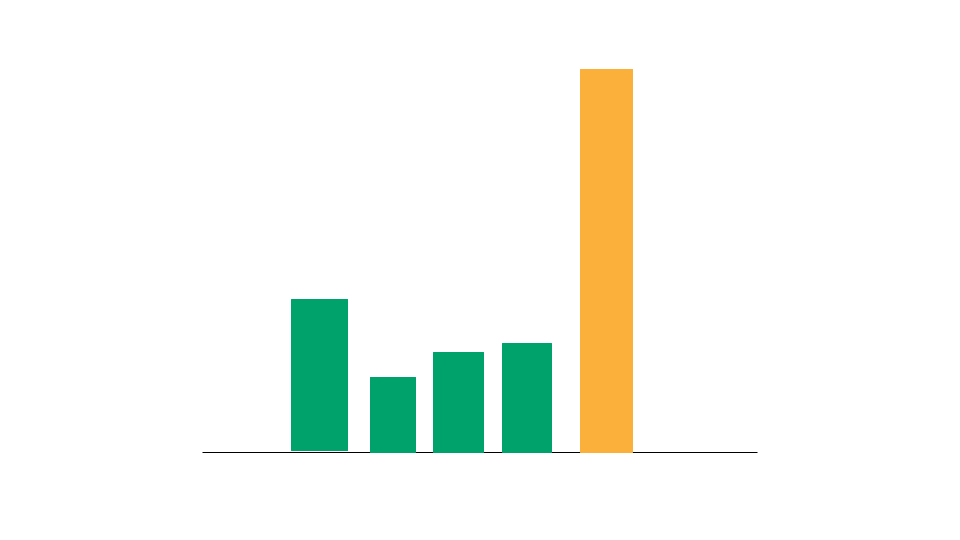

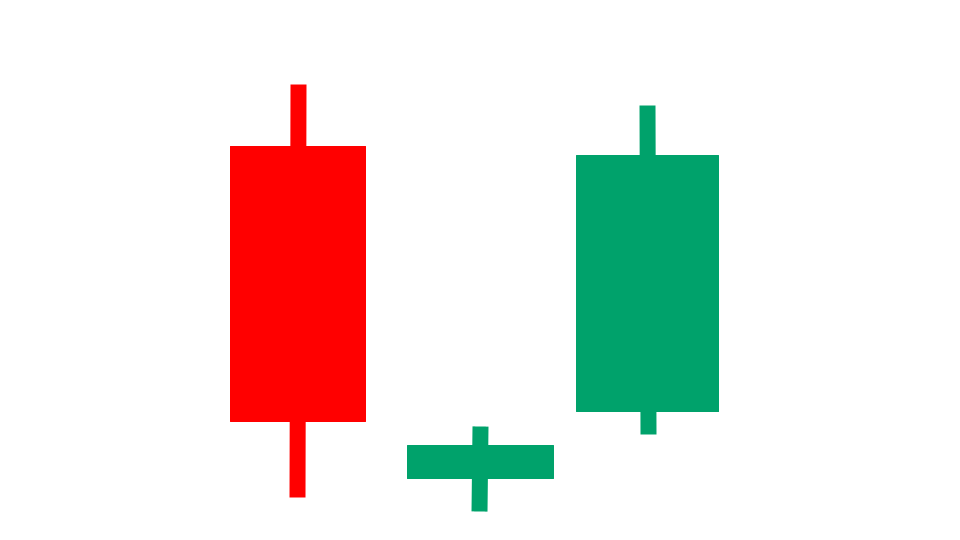

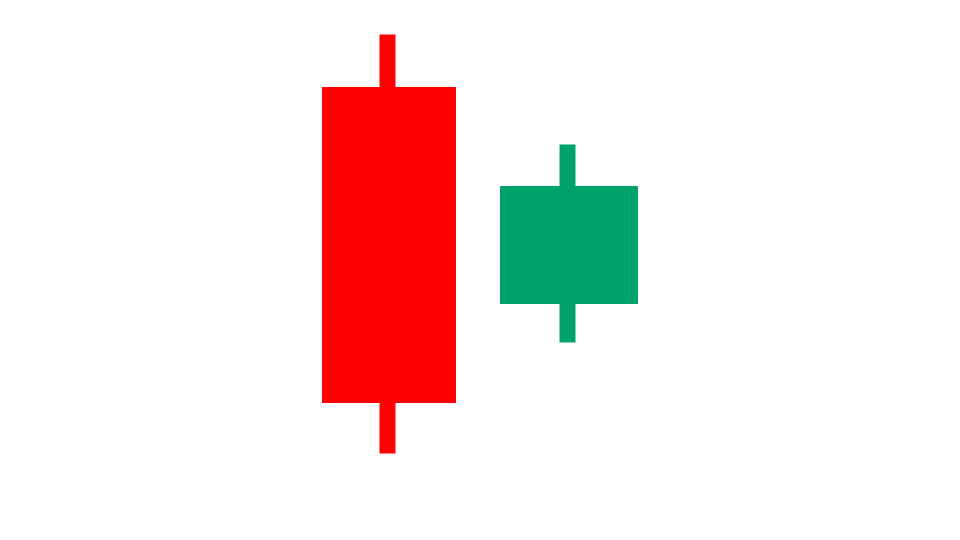

Candlestick Pattern Scanner

Our scanner finds stocks exhibiting the following popular stock candlestick patterns:

About Stock Market Guides

Data and trading are our specialties. Over the course of several years, our team has researched tens of millions of backtested trade outcomes. We've done this by writing algorithms for trading strategies and testing them against historical stock prices.

As Seen On

Customer Testimonials

I'm making money, that's what matters. Well worth the $70 per month. I hope to, and plan to, use your service for as long as you'll have me.

James from Alabama

Without exaggeration, thus far your service has cut my research time by at least 35% - 40%. Regards from a happy user.

Dennis from Florida

I am new to options trading and I've only been trading the last two months and I've been profitable both months with the help of the Stock Market Guides.

Sam from Texas

So far for September, I have 10 completed trades. 9 had gains, 1 was a loss.

Lori from Arkansas

FAQs

Videos About Our Service

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.