Identify Investing Opportunities

Stock Market Guides identifies stock and options trading opportunities that may have a historical track record of profitability.

Never make blind trades again. Our trade alerts put the historical performance of each trade setup at your fingertips.

Get Trade Alerts

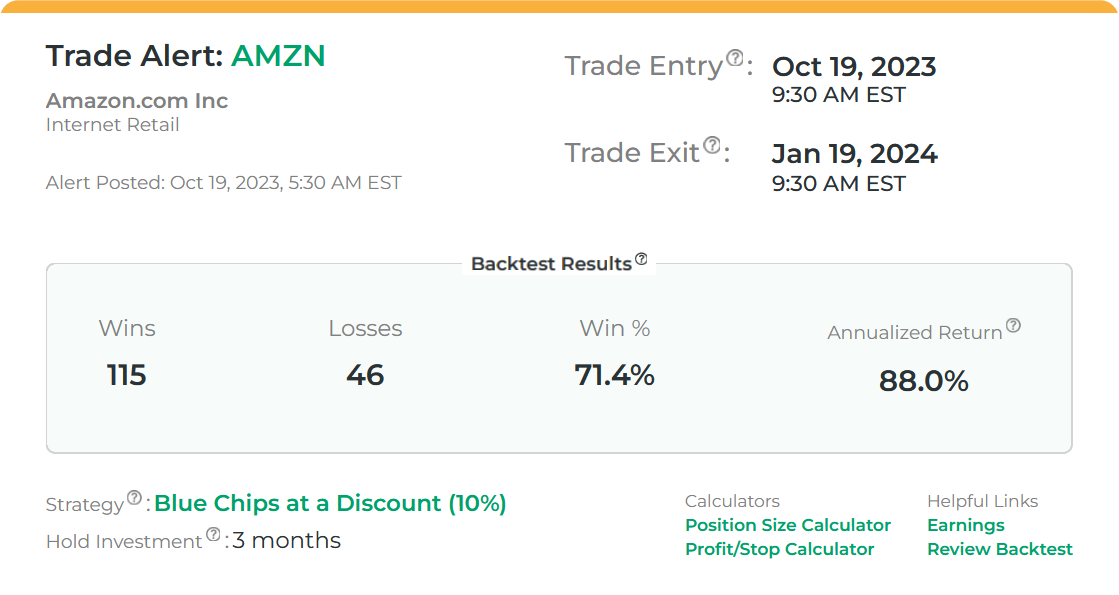

Each time we see one of these opportunities, we send you a trade alert that tells you the backtested performance of the trade setup, like this:

(sample trade alert)

All our trade alerts are powered by our proprietary scanner software. You can adjust the filters to do custom scans for trade opportunities.

See PricesServices We Offer

We offer trade alerts for both stock picks and option picks. Each of our services includes an email newsletter that offers analysis from our trading experts.

Stock Picks:

Backtest ResultsThis is how our stock picks for this service performed in backtests. When we run a backtest, what we’re doing is taking a given trade strategy and looking back at history to see how it may have performed in the past.

Wins

168,968

Losses

108,404

79.4%

Option Picks:

Backtest ResultsThis is how our stock picks for this service performed in backtests. When we run a backtest, what we’re doing is taking a given trade strategy and looking back at history to see how it may have performed in the past.

Wins

136,786

Losses

103,683

150.4%

Easy to Follow

Subscribers get an alert for each trade opportunity we find. We tell you the exact stock or option and a history of that trade setup’s performance, and then you simply decide whether to buy or not.

The alerts can be very convenient for people who have limited time or need to trade on the go.

Flexible Trade Lengths

Our alerts are for trade opportunities designed to last anywhere from 3 days to one year. Our service caters to swing traders and longer-term investors.

Subscribers can easily adjust which trade durations they prefer to get alerts for.

About Us

Data is our specialty. Over the course of several years, our team has researched tens of millions of backtested trade outcomes.

More About UsAs Seen On

Customer Testimonials

"I am really enjoying the new service and feel like it is going to be attractive to novice and intermediate investors. You do a fantastic job of providing both simplicity and education for those who want to learn more."

Jeff from Tennesse

"I very much appreciate you taking the time to make a video to explain the pattern set-up. I only joined the service last week, but I am very impressed with the level of customer service you provide."

Gary from Virginia

FAQs

Can I cancel any time?

Absolutely. There is a button on the “My Account” page that allows you to cancel. That will discontinue all future billing. You only get charged for one month at a time, so you are never committed to the service for any longer than the current month.

Will you be available to help if I have questions about any of the trade alerts?

We sure will! You can contact us any time if you have questions about the trade alerts or about anything else related to our service. We’ll be ready to help.

What do I need to get started?

The main thing that you need in order to act on our trade alerts is a way to buy and sell stocks or options, depending on which service you sign up for.

This normally entails having a brokerage account. If you already have a brokerage account, then you’re all set to go. If you don’t yet have one, there are a number of free brokerage accounts available for you to consider. We like Thinkorswim.

I am a beginner. Will this service be a good fit for me?

We work really hard to make sure that our trade alerts are as simple as possible. We hope that makes it easy for beginners to benefit from them.

If you are brand new to trading, we have free guides that can help you. At bare minimum, you need to know how to buy and sell. If you're interested in our stock picking services, you can check out this guide that teaches how to buy and sell stocks. If you're interested in our option picking services, you can check out this beginner's guide to options.

Videos About Our Service

Free Educational Guides

This guide will help those beginners who have never bought stocks. As you'll see, getting started is not overly complicated.

This guide will help beginners by explaining in plain English what options are and how to buy options.

Learn the difference between call options and put options and see an example of how each one works.

The bid and ask are two key elements that determine the current price of any given stock or option. This example should help make it easier to conceptualize how they work.

This guide offers a review of the Thinkorswim trading platform by TD Ameritrade. We cover the pros and cons of the software from an active trader's perspective.

Learn the difference between extrinsic value and intrinsic value for options and see how each is calculated.

Join Our Free Email List

Get emails from us about ways to potentially make money in the stock market.